From 2016 to 2017, furniture store sales grew 1.9 percent, while home furnishings stores climbed 7.8 percent, nearly four times faster. A new study pinpoints reasons why.

Americans’ vision of the homes they live in is changing, as are the roles and functions they want their homes to play in their lives. Home has become a reflection of their personalities and values, which increasingly lean toward a simpler, functional and practical style personalized to support the way they live today.

Better Homes & Gardens magazine recently surveyed 1,600 female homeowners. The study found that 63 percent of Millennial respondents believe that having a home customized to their tastes and needs is a top priority. Sixty percent of this group, the next big generation of home-buying consumers, also said that having a home that is "a reflection of me" is more important to them than to their parents' generation.

Democratic Design

A whole new range of retailers, many of which traditional furniture stores haven’t viewed as direct competitors, are answering a need for home furnishings customized to younger consumers’ tastes and lifestyles. “Democratic Design” has become the umbrella under which these emerging brands market.

The phrase “democratic design” was originally coined by designer Philippe Starck as “design that provides quality pieces at accessible prices.” IKEA was one of the first brands to whole-heartedly embrace the idea. It expanded the definition to include five key principles: form, function, sustainability, quality and low price. Target has just launched a new line of furnishings under the same “democratic design” banner, called Made By Design.

This idea of “democratic design” is poised to disrupt the traditional home furnishings and furniture market in much the same way “fast fashion” did to the traditional fashion business. Along with its grounding principles of form, function, sustainability, quality and low price, democratic design is also fast and fashionable.

Furniture Retail Disrupted

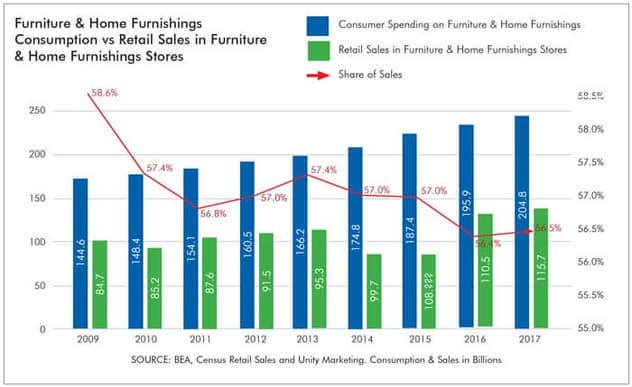

As of yet, disruption of traditional furniture retail is measurable, but has not yet progressed as rapidly as in other consumer goods categories, such as grocery and fashion. But that is sure to change. At the macro level, consumer expenditures on furniture and home furnishings has grown 42 percent, from $144.6 billion in 2009 to $204.8 billion in 2017. But during that time, furniture and home furnishings stores’ share of those sales has declined, from nearly 59 percent in 2009 to 56.5 percent in 2017. Making up the difference is online retailers’ and other retailers’ share, i.e. general merchandise stores like Target and Walmart, and big box building materials stores like Home Depot which is expanding its furniture selections.

"Democratic Design is poised to disrupt the traditional home furnishings and furniture market in much the same way as 'fast fashion' did to the traditional fashion business."

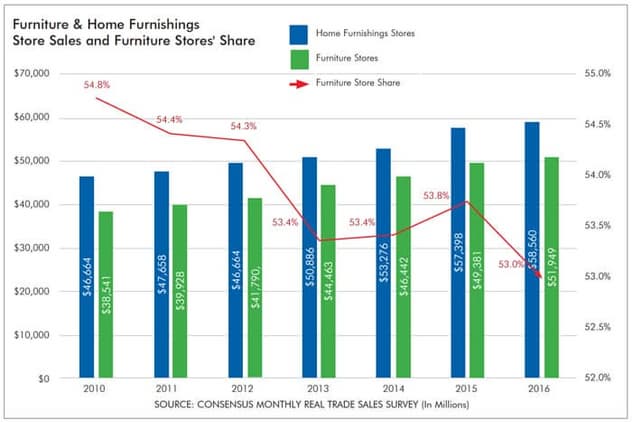

Traditional furniture stores are also losing share. While sales in furniture stores grew 25.4 percent from 2010 to 2017, the overall share of the combined furniture and home furnishings store sales has declined from 54.8 percent to 53 percent over that time. In other words, stores that sell a broader range of home furnishings, including furniture, housewares and decorative accessories advanced much more rapidly, 34.7 percent.

Given the break-neck pace at which the consumer market is evolving in so many different categories, traditional furniture retailers are in danger of being left behind unless they take steps now to reverse the decline and remain relevant to the needs of today’s home-hungry consumers.

New Industry Study

Furniture World magazine and Unity Marketing worked together to assess the state of furniture retail today and look to its future. In a survey conducted among 350+ furniture retailers and manufacturers, we found that furniture retailers underestimate the fierce competitive pressures they face.

While they widely recognize the threat online furniture retailers represent, with nearly two-thirds (63 percent) identifying e-commerce furniture brands like Wayfair, One Kings Lane and Overstock.com as competitors, they are far less concerned about encroachment of national mass market home furnishings retailers, like IKEA, Pottery Barn, and West Elm (27 percent) and major mass-market retailers that also offer furniture and home furnishings (15 percent), like Target, Walmart, TJ Maxx, and Kohl’s.

Further, Amazon is only viewed as a threat by 40 percent of furniture retailers, a major oversight. Amazon has over 100 million Prime members who pay a premium price for a subscription to the service, and it is now offering two furniture house brand offerings, Rivet and Stone & Beam.

The picture that emerges from this study is that traditional furniture stores believe they have a secure place in the furniture market. But, a growing body of faster, more adaptable competitors are responding to consumers’ need for speed, style and affordable price. Disruptive competitors are nipping at their heels and could well overtake traditional furniture retailers as they scale in the furniture space.

“Our biggest challenge is how to reach clients who have the means to purchase our high-end furniture. They still exist but it is really hard to find the right media that we can afford,” commented a furniture retailer in the survey.

I would add that the problem for this retailer is not just finding the right media to reach their best furniture prospects, but also finding the right message.

Help Customers Turn Their House Into A Home

In the survey, besides worries about online competition disrupting their businesses, furniture retailers see attracting the next generation of furniture customers to their stores as their primary growth challenge. And they believe that mastering the internet and social media – the next generation’s primary tools – is the primary means to do that.

While this is critically important today, and a major challenge for many traditional furniture retailers that came of age in a pre-internet world, just being there isn’t enough. Retailers have to communicate a marketing message that attracts these next generation customers.

In fishing, just dropping a hook into the water and expecting to catch fish isn't enough. The hook has to be baited with something that will entice the right kind fish to bite. So it is with the next generation of furniture customers. Your marketing bait must grab their attention so that it becomes possible to reel them in.

Success in retail today is less about WHAT you sell and more about HOW you sell it. In the case of furniture retail, the furniture you sell is the customer’s starting point for furnishing their houses. Decorative accessories, however, are what turn their houses into homes.

“Consumers no longer want to be just consumers. They want to be creators! ‘Personal Fashion’ is now driving ‘Personal Homes,’” says Jill Sands, The Trend Forecaster.

Furniture alone won’t allow them to create their personal home. Decorative accessories will. The survey reveals that this potential is largely overlooked by traditional furniture stores. Only 37 percent of the furniture retailers surveyed said that decorative accessories are very important in driving sales and attracting customers to their stores.

At retail, home furnishings stores are doing far better than those classified as furniture stores. From 2016 to 2017 furniture store sales only grew 1.9 percent, while home furnishings stores, climbed 7.8 percent, nearly four times faster. What’s the difference? Home furnishings stores focus on decorative accessories!

Mary Liz Curtin, owner of lifestyle and furniture store Leon & Lulu, located in Clawson, Michigan, a Detroit suburb, has advice for furniture stores: Accessorize. She says, “We are accessory heavy. Many furniture stores have the same accessories that have been kicking around for years.” Accessories add vibrancy to any room setting, and Leon & Lulu works them for all they are worth.

Plus, when times got tough, selling furniture back during the Great Recession, the accessories kept the store afloat. “We were lucky to have small things to balance the sales. But today, those customers who bought the small indulgences and gifts in 2008 are back to buy big-ticket furniture,” Curtin adds.

Go Deep, Go Long, Go Bold with Accessories

To attract next generation customers, your marketing messages must communicate how your store is a place where they can bring their personal design vision to life. Furniture is only a part of that vision. Accessories breathe life into that vision and add verve to store displays that will excite customers and get them to spend more time, and hopefully more money.

“Accessories are where retailers can play with color,” says Patti Carpenter, president Carpenter + Company. “It’s easy to bring in colors with pillows, throws and other accent textiles, also vessels, vases and similar items. That’s how to add a dash of inspiration.”

Too few furniture stores know how to use accessories to the max. The thought is that accessories are only there to “make the furniture look better,” but just as the addition of well-chosen and placed accessories can change the whole look of a room, the right accessories used strategically can change the whole experience of the store for customers.

“Some furniture stores view accessories as a painful necessity,” says David Gebhart, CEO Global Views. “But once they commit to accessory programs, they are surprised by the volume they can do.”

Customers want to see something new and different every time they come into a store. Accessories can provide that experience. “Stores that are under-accessorized are just not putting their best foot forward with the tools they have to work with,” says Jason Phillips, VP Phillips Collection. “Many stores, especially single store retailers and small to mid-sized chains need to be more confident in their buying position and in their store aesthetic.”

"While sales in furniture stores grew 25.4 percent from 2010 to 2017, stores that sell a broader range of home furnishings, advanced much more rapidly, 34.7 percent.

Accessories greatly enhance opportunities for add-on sales and increased average sale. “Accessories can be a huge profit center for any store. Those that do it right see a high return on investment from the home accent side,” says Sharon Davis, executive director of Accessories Resource Team.

Furniture retailers need to hire the right people with the right skills and a good eye to buy accessories. “Furniture buyers don’t necessarily know how to style a room. They may know the costs, the turns and margins on categories and individual pieces, but not always the best way to finish the room. That is where the money is made,” says Paul Thompson, a consultant in space planning.

What RH, West Elm, Pottery Barn & IKEA Understand

Furniture is now a fashion business. RH, West Elm, Pottery Barn, IKEA and Wayfair understand this. The old “consumer durable” way of thinking in the furniture industry has passed. Consumers increasingly are turning to ‘fast’ furniture instead of ‘forever’ furniture choices. The problem for many furniture retailers is 'fast-furniture’ can't be sold with a ‘forever-furniture’ approach.

Find The Right Mix

Think about mixing ‘fast’ furniture with ‘forever’ furniture lines, as this retailer who responded to our survey has done:

“Even I am attracted to the cheap, but cute new furniture offerings! They're hard to resist when they are marketed so well online. I'm opening accounts with some new cheaper furniture lines, too, so I have a broad range of offerings.”

But fashion is fleeting. It needs to be changed up regularly, which is where decorative accessories can give traditional furniture retailers an edge.

"The survey showed furniture retailers are far less concerned about encroachment of national mass market home furnishings retailers (27 percent) and major mass-market retailers that also offer furniture and home furnishings (15 percent)."

All the while, classic furniture design does last a long time. “Quality furniture never goes out of style,“ noted another retailer who responded to our survey.

To successfully sell forever-fashion furniture, retailers need to educate the next generation of customers so that the value of their products becomes tangible.As another retail respondant to the survey said. “I still have clients that want quality furniture. I educate them about differences in cushion content, fabric durability, and value. It's complicated to decide which product truly is the best quality and value, so even being educated I have to just pick one.”

The Full Report: The full report, "Furniture Retailing in an Internet-Disrupted Market", available from Unity Marketing for $99, is a research-based look at furniture retail today and how retailers are fighting back against the online/ecommerce onslaught.

It reports the results of an online survey with n=369 furniture retailers and marketers about their business, views of the competition, advertising, marketing and digital strategies and how they are prospering in the new experience economy.

This report also provides analysis to help retailers make the research findings actionable. https://unitymarketingonline.com/shop/buy-luxury-research-reports/furniture-retailing-in-an-internet-disrupted-market/.

About Pam Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer segment. She is president of Unity Marketing, a boutique marketing consulting firm she founded in 1992 where she leads with research to provide brands with actionable insights into the minds of their most profitable customers.

She is also a founding partner in Retail Rescue, a firm that provides retailers with advice, mentoring and support in Marketing, Management, Merchandising, Operations, Service and Selling.

A prolific writer, she is the author of eight books including Shops that POP! 7 Steps to Extraordinary Retail Success, written about and for independent retailers. She is a contributor to The Robin Report and Forbes.com. Pam is frequently called on to share new insights with audiences and business leaders all over the world. Contact her at pam@unitymarketingonline.com.