Bill says, follow the money and focus your marketing on the Baby Boom generation. Ed says "'The Times They Are a-Changin'"!

Editor’s Note: Here's more from Furniture World's point/counterpoint duo, Bill Napier and Ed Tashjian. This is their fifth installment, having previously debated celebrity licensing, digital advertising overload, the millennial myth and whether or not furniture brands matter.

Point: Bill Napier

Hey retailers, where is all the money? I’ll “show you the money”. I’ll write, show you the facts, and you decide if your marketing is on or off target.

Boomers over 50 years old buy 50 percent of everything and control 70 percent of all disposable income

Recently the digital marketing industry went into a meltdown when Procter & Gamble announced they were ditching digital… because it was NOT moving the needle .. AT ALL!

In July 2017, It was reported in the Wall Street Journal (https://www.wsj.com) that Procter & Gamble cut $100,000,000.00 out of their budget... Eliminating digital advertising. They are the largest advertiser in North America. Got your attention yet?

So, THE question for retailers is… who are you marketing to? Not me, and I’m one of those 70-percenters.

I’m a Boomer, as is my wife. We watch TV. We look at the messages and especially the actors who deliver those messages, not to mention the images, sounds and scripting... most of the time with disbelief. We always ask ourselves, who are they speaking to? And, more often than not, we have NO desire to engage with those brands. Here’s why.

Advertisers aren’t speaking to us. They aren’t even trying, and most often they offend our intelligence.

I roll my eyes when brands depict men as DWEEBS defined as, “A person regarded as physically and socially awkward and having little confidence." And, sometimes they're just plain foolish.

They depict women as, lacking intelligence and independence. These women are supposedly in relationships with the Dweebs, and they roll their eyes at their ineptness and childish behaviors, accepting that they’re idiots. So, are advertisers asking their audience to believe that these men are supposed to be alluring or attractive to them?

The point is, none of these characterizations reflect who we are, our needs or aspirations. And I’m willing to bet that for Boomers like me, these characterizations are just plain insulting to both genders.

Why Is This Happening?

My guess is that the people creating these types of marketing platforms/messaging are actually targeting themselves, their demographics, and what’s funny to them, not the people with the money, BOOMERS!

If you’ve read past installments of this Point/Counterpoint series, you already know it drives me nuts when so called marketers don’t do their due diligence.

That’s MY perception and thankfully I have a DVR, stream Netflix and I don’t have to watch many of these messages. So, I don’t have to roll my eyes all the time, which eliminates headaches.

The problem as I see it is most Furniture World readers' messaging is overly focused on marketing to Millennials. And this focus is often driven by Millennial marketers who believe that most retail marketing dollars should be directed to Millennials, as well. But, Millennials don’t have much money if any at all. This was documented in March/April 2017 Furniture World, “A Millennial Myth”. I get it, they are the largest demographic and you want to be sure you capture their hearts, minds, and souls for your brand/store….LONG TERM.

But, consider this when everyone tells you to spend all your money on them.

1. The average 19 to 34 year-old Millennial has a credit score of 625, the worst credit score of any generation.

2. The current savings rate for Millennials is negative 2 percent.

3. 31.1 percent of all U.S. adults in the 18 to 34 year-old age bracket are currently living with their parents.

4. A survey conducted earlier last year found that 47 percent of all Millennials are using at least half of their paychecks to pay off debt.

5. AND... Millennials hate your digital ads!!

OK, I need to clarify about this age group. I have three Millennial kids. They are very successful and these numbers don’t apply to them or to many in this generation. Yes, they are starting to buy homes, improve their financials, find better jobs, but facts are still facts.

Here’s my concern for your bottom line. By listening to all the Fad Marketing Hype, you are missing out on attracting the people who have almost all the money right NOW.

All The Money

Boomers who are 50-plus years old have most of the buying power. According to Visa, they will drive consumer spending for the next 5-10 years!

In an article published in 2016 titled, “Gray is the new black: Baby boomers still outspend Millennials”, Visa (https://usa.visa.com) reported, “Consumers over 50 now account for more than half of all U.S. spending…. By 2020, there will be about 11 million more consumers over age 60. While the share of spending among younger consumers is expected to decline over the next 10 years, older boomers should gradually spend more, with those aged 60+ reaching a 33 percent share of aggregate spending by 2025.”

In the first quarter, Americans 55 and older accounted for 41.6 percent of consumer spending, up from 41.2 percent late last year, and 33.5 percent in early 2007, according to government and Moody’s data.

Toss in 53 and 54-year-olds and the boomer and-older set comprise about half of all consumption, according to Visa and Moody’s analytics.

Women boomers influence over 80 percent of purchase decisions (Source: Media Post, "Wake Up, Marketers: Boomer Women Have Money to Spend" www.mediapost.com), yet most furniture retailers are spending less than five percent of their marketing dollars to influence them.

Just The Facts

1. 70 percent of the disposable income in the U.S. is controlled by Baby Boomers. (Source: Nielson "Introducing Boomers: Marketing's Most Valuable Generation" www.nielson.com).

2. There are 74.9 million Boomers -- ages 51 to 69 in the U.S. (Source: Pew Research Center, " Millennials overtake Baby Boomers as America’s largest generation" http://www.pewresearch.org).

3. The 50+ population has $2.4 trillion in annual income in the U.S., which makes up 42 percent of all after-tax income. (Source: Immersive Action, "50+ Facts and Fiction: Size, Wealth and Spending of 50+ Consumers" www.immersionactive.com).

4. According to the U.S. Bureau of Labor Statistics, boomers account for 48 percent of consumer expenses each year, which means that if you target them, you can expect a higher ROI.

5. Boomers own 80 percent of all money in savings and loan associations.

6. 49 percent of Baby Boomer tablet users and 40 percent of smart phone users made a purchase after conducting searches on their devices.

Boomers are Savvy

When it comes to shopping on mobile devices, one in four people aged 55 and older do so, according to a report by BI Intelligence, a research service from Business Insider.

Further, 24 percent of online shoppers fall between the ages of 45 and 54, though that age group represents less than 20 percent of the population. Boomers generate more than 51 percent of the spending in the United States and have a total annual economic activity of roughly $7.6 trillion, according to AARP.

Regardless of where or how that 51 percent of spending occurs, the fact is, older consumers are a sizable and potentially lucrative long-term market base for digital retail.

For instance, Boomers purchase half of the computers and two-thirds of the new cars sold annually, according to Bloomberg Business Week. OMG, imagine what they could be spending in your store IF you marketed to them?

Baby Boomers are expected to inherit $8.4 trillion by 2030, according to research by the Center for Retirement Research at Boston College. This means their spending power is likely going to escalate, and possibly in windfall ways.

Suggestions

- I suggest you pull a demographic profile of your customers (including your best customers) and also on your operating area so you can see “where the money is”.

- Do a marketing analysis in-house, or hire a marketing agency who can ask the right questions and supply you with detailed information and provide suggestions on how you can target your best prospects.

Or, keep marketing to the Snapchat Generation and see where that gets you!

Counterpoint: Ed Tashjian

I feel compelled to remind my dear friend and colleague Bill, that in the 60’s Bob Dylan penned a song, “The Times They Are a-Changin”. I encourage those in the Boomer generation who thought that our parents, congressmen, and people who are now our age, were out of touch dopes, to revisit Dylan's lyrics included at the end of this article.

Alas, there is more to economics than counting the money. The only proven way to predict the future is to follow the demographics, historical purchase patterns, and common sense. It doesn’t really matter where the wealth is concentrated. That is a red herring. Whether you are rich or poor, old or young, everyone needs a place to sleep, a place to eat and a place to watch television. In other words, everyone needs furniture. They may have less money to pay for it, but they still need it. Let me remind you Bill, why you were so successful at Ashley. While those of us in the traditional ranks of home furnishings watched our share dwindle while we proselytized the value of the details of fine finishes and craftsmanship—Ashley pioneered the concept of buy it today, have it in your home tomorrow, and don’t pay for it for several years. This appealed greatly to the 35-44 cohort, and I would argue that this is still a good strategy.

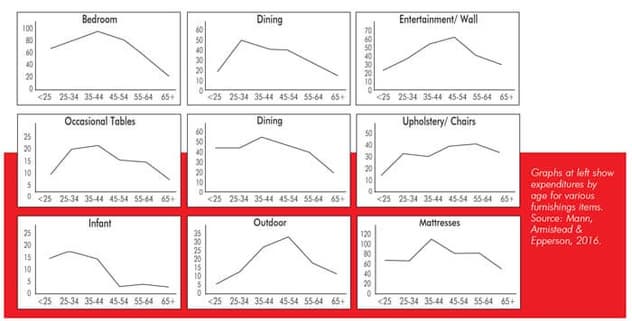

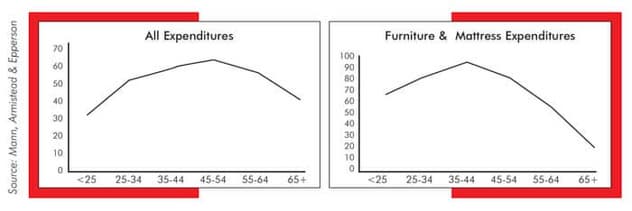

In 2016, Jerry Epperson published a set of charts chronicling expenditures by age for the various furniture categories (below). The chart on page 18 is probably the most instructive because it splits out "furniture and mattress expenditures" from "all expenditures". To make a long story short, furniture purchasing peaks in the 35 to 44 age cohort, and declines precipitously from there. With the exception of the outdoor and upholstered chairs, that trend is pretty consistent.

Let me remind the reader that the so-called Millennial’s are now 21-37. Demographers disagree, but the date range most experts use comes from Pew Research Center, because they are most reputable. They peg Millennials as those who were born between 1981 and 1997. And, while Boomers and Millennial’s are approximately equal in size now, you can see Boomers will drop precipitously in the near future.

To use a hunting analogy, if you were shooting ducks, you would need to lead them by shooting in front of them. If you shoot at them or behind them you will miss them every time.

To translate this metaphor into furniture marketing, you better be prepared to start targeting Millennials. You will get a few Boomers who think of themselves as being young at heart. If you watch enough television you will be reminded that we are a culture that celebrates youth. And, whether it is fashion or technology, the models used are always 10 years younger than the target.

Let’s set aside the facts, figures and statistics for a minute and approach this question with common sense. Why do Boomers buy less and less furniture the older they get?

1. They don’t need it. They have already bought furniture and, regrettably in some ways, the quality is excellent. It hasn’t worn out, and it’s not really out of style.

2. It falls under the category of “stuff.” As people age, so do their views on the meaning of life. “Stuff” no longer represents status, but is rather an albatross that weighs you down and requires maintenance. The truth is, most boomers are trying to get rid of stuff, not acquire more. They are dumping second homes, giving away excess furniture, and de-cluttering in general. They have recently had to deal with their parents depression era hoarding mentality, and do not want to burden their children with the same exercise of disposing of their parents' belongings when they pass.

3. Unlike technology, there is little obsolescence for furniture. Except for changes in fabrics, sofas looks pretty much the same as they did only 15 years ago. Traditional furniture, based on 18th-century styling, is making a comeback—which says a little about how stale our industry has always been when it comes to fashion.

4. For simplification, let’s divide boomers into two categories. Those who retire with a great deal of wealth, and those that retire without significant savings. For those who worried about subsistence and outliving their money, furniture is the last thing on their shopping list. Those with wealth already have nice things and want to spend the money on their children and on experiences.

It’s not all doom and gloom. I have great confidence in the home furnishings industry because people will always need what we have to offer. The U.S. furniture industry has grown at a CAGR of 5.6 percent for the period from1970 to 2016, while remaining stable during economic cycles. Our sector has experienced positive year-over-year growth in 41 out of 46 years, and experienced sales declines of greater than 3 percent in only three periods. This is a very healthy industry that has not suffered disruption like other sectors. And, regardless of external factors, people need to eat, sleep, and consume media.

Now Bill, let me address your condemnation of digital advertising. I agree, that for the most part, digital advertising is ineffective. Let me remind you that the reason that Procter & Gamble, and everyone else who hopped on the bandwagon, went to digital advertising is because traditional advertising was ineffective. My conclusion is that consumer advertising is fairly ineffective. I would argue that the reason it doesn’t work is because there are so few differences in products worth advertising. The goal of advertising it is to communicate why your product is different and better and how it fills a real or psychological need. Most products aren’t different and the needs we have today are less likely to be fulfilled by stuff.

You and I each make our living by counseling the home furnishing industry on how to grow their businesses. While we may have different tactics, I think we agree, at the essence of success is differentiation. That can take the form of products, service, convenience or channels of distribution. Any one or combination of these deliver superior value, and it is up to marketers to communicate what that difference is and why it matters. Marketers must always reinvent themselves, for the times they are changin’.

About Ed Tashjian: Tashjian Marketing provides senior marketing leadership to the Home Furnishings Industry. It specializes in business analytics and in helping its clients to segment the market, define and communicate a sustainable differentiated value proposition. Get more information at www.Tashjianmarketing.com or call (828) 855-0100.

About Bill Napier: Bill is Managing Partner of Napier Marketing Group. He has been the chief marketing officer of several small, medium and large companies throughout his career, most notably Ashley Furniture Industries.

Bill is also a featured writer and speaker in the retail industry. His passion is to help retail brands & brick mortar retailers grow their businesses by creating, guiding and deploying successful marketing B2B/B2C solutions integrating traditional marketing with the web/social media. He has demonstrated this with his FREE website www.social4retail.com with hundreds of articles and “how-to” strategies for retailers and brands. Bill can be reached at: billnapier@napiermkt.com or 612-217-1297.

The Times They Are A-Changin' by Bob Dylan

Come gather 'round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You'll be drenched to the bone.

If your time to you Is worth savin'

Then you better start swimmin'

Or you'll sink like a stone

For the times they are a-changin'.

Come writers and critics

Who prophesize with your pen

And keep your eyes wide

The chance won't come again

And don't speak too soon

For the wheel's still in spin

And there's no tellin' who

That it's namin'.

For the loser now

Will be later to win

For the times they are a-changin'.

Come senators, congressmen

Please heed the call

Don't stand in the doorway

Don't block up the hall

For he that gets hurt

Will be he who has stalled

There's a battle outside

And it is ragin'.

It'll soon shake your windows

And rattle your walls

For the times they are a-changin'.

Come mothers and fathers

Throughout the land

And don't criticize

What you can't understand

Your sons and your daughters

Are beyond your command

Your old road is

Rapidly agin'.

Please get out of the new one

If you can't lend your hand

For the times they are a-changin'.

The line it is drawn

The curse it is cast

The slow one now

Will later be fast

As the present now

Will later be past

The order is

Rapidly fadin'.

And the first one now

Will later be last

For the times they are a-changin'.