The essential question marketers must ask is what does this affluent demographic group want for their homes?

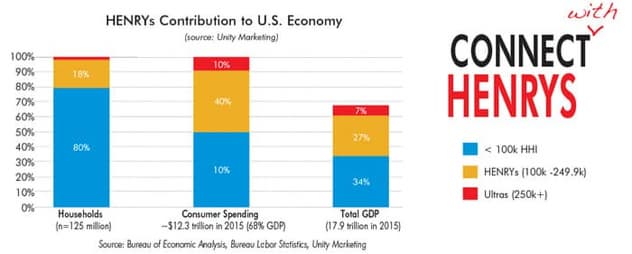

In targeting the HENRYs (high earners not yet rich) and their home decorating needs, the essential question all marketers must ask is what do HENRYs want for their homes? Unity Marketing has identified three key trends shaping the future of the home furnishings market based upon shifting values in the mindset of the HENRYs, particularly young HENRYs on the road to affluence.

Smaller Space - Bigger Living

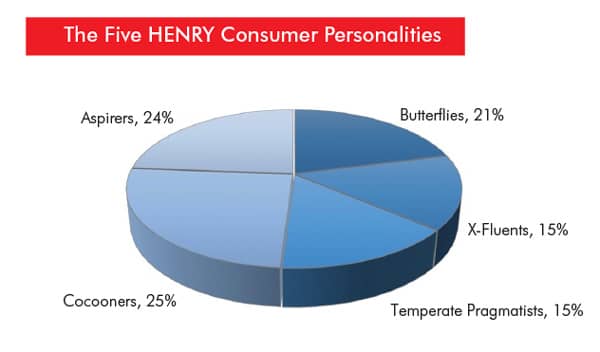

It was mentioned in the first part of this series published in the May/June 2017 issue of Furniture World Magazine, that the tiny house trend fits perfectly with Temperate Pragmatist consumer psychology, briefly described in the chart caption on page 54. But it’s also an emerging trend across an entire younger generation of consumers.

Today people are seriously evaluating their lifestyles, what they need, what they own and most importantly, what they really need to own. It’s a mindset focused on doing more with less, and many young HENRYs are adopting the tiny house mindset, even if they haven’t moved into tiny houses.

It’s a focus on quality of life, not quantity of possessions. It means they are making strategic compromises based on value. Here are some ways they are expressing it:

- Spending only $50 for dinnerware set of eight place settings, but purchasing a $500 KitchenAid stand mixer;

- Buying a boxed wine for $20, but serving it in $20 per Riedel stem wine glasses;

- Paying $.49 per sq. ft. for laminate flooring and $300 for an area rug at IKEA, but choosing to spend $500 on a Dyson vacuum cleaner and $2,000 on Natuzzi leather sofa.

Focus On Quality Of Life

Confusing? Not to HENRYs! What distinguishes the choices above – KitchenAid, Dyson, Natuzzi, Riedel – is strong branding around a powerful quality message. Without it, a product becomes a mere commodity.

Home marketers need to use branding and marketing to make the value proposition crystal clear, otherwise HENRYs will opt for the cheaper choice.

Function and Style

It’s substance over style for HENRYs. When weighing purchase decisions, HENRYs favor options that give them the utmost in practical utility and function over a choice that looks good but is lacking in quality and substance. And if a choice offers both function and style to the highest standards, HENRYs will pay the premium required. They favor choices that don’t require compromises, but when they have to choose, they opt for maximizing function and utility over style alone.

That’s why IKEA is moving aggressively to enhance the quality and function of its home décor offerings. Known for its "look for less" furnishings, IKEA determined its furniture needed a serious makeover on the inside to improve quality, so that its furniture is more durable and delivers more comfort along with style.

It’s a strategy custom made for HENRYs which makes IKEA the second most popular HENRY home furnishings’ shopping destination after Bed, Bath & Beyond in Unity Marketing’s most recent Affluent Consumer Tracking Study.

Luxury in a Brand New Style

Especially among the Gen X and Millennial generation affluents, the old style of luxury has taken on many negative connotations. For them, old luxury reeks of over-indulgence, conspicuous consumption, elitism, extravagance, status seeking and, most especially, reflects income inequality and the excesses of the one percent. Brands need to market luxury in a new style that reflects the next generations’ values.

Mistakenly, too many luxury brands call the HENRYs aspirational, which implies their aspirations align with their old style concept of luxury. Aspirational the young HENRYs may well be, but not necessarily for the old luxury that these brands are selling.

Rather, HENRYs are aspirational for an authentic lifestyle and true happiness, which research shows comes by what they do and experience, not what they have or own. This shifts in consumer psychology calls on luxury brands to tell new stories. Young HENRYs reject their parents’ and grandparents’ ideas of luxury in favor of concepts that are more practical, functional, inclusive, democratic, responsible, and, ultimately, more affordable.

Surely, HENRYs want high quality, superb workmanship, and all the other quantifiable features that luxury home brands promise. But they also want to align their consumer behavior with their personal values. Too many young people believe that the term “luxury” signifies something is over-priced.

So calling a brand luxury doesn’t necessarily make it so. In fact, if you have to call it luxury, it probably isn’t. The title of “luxury brand” must be earned in the mind of the consumers. It can’t be a label that a brand claims for itself. Therefore, use the L-word with extreme caution and learn how to communicate luxury in a brand new style.

New Demands New Ways To Market

The question of "how to find new customers" rose to the top as the biggest challenge to growth in a recent survey of luxury industry insiders conducted by Unity Marketing in association with Luxury Daily.

The answer for home furnishings marketers is here: It’s the HENRYs!

For HENRYs, particularly young affluents 24-44 years old who will become the next generation of luxury consumers, making money, getting promoted, or becoming a partner is all well and good, but traditional accomplishments are not the only prize they are after.

More important to this group is the accomplishment of achieving a personal goal and digging deep to succeed at something truly remarkable, like completing an Iron-man triathlon or doctoral dissertation.

These smart, accomplished young people know that by choosing the right profession and working hard at it, just about anybody can make a lot of money, if that is what one aims for. But HENRYs measure their success in ways more personally meaningful than just financial success. That’s why for many HENRYs, luxury-brand watches have lost much of their status-symbol cachet, since owning one mainly communicates how much money one makes and spends. HENRYs are looking for brands that communicate something more meaningful than just net worth.

For young HENRY affluents, there is a distinct generational component to their chosen status symbols. They reject their parent’s or grandparent’s status symbols, in favor of symbols that communicate to their peers to which ‘tribe’ they belong.

So HENRYs’ status symbols are less about traditional high-end luxury brands and more about brands that really express one’s values and identity. Think a Mini Cooper, rather than a Mercedes; or a Filson messenger bag, rather than one by Louis Vuitton; or a Shinola Runwell watch, instead of a Rolex.

That said, the TAG Heuer watch brand, after an unsuccessful attempt by corporate parent LVMH to move the brand upmarket to compete in the luxury price range of $5,000-$10,000, has recently reversed course, and brought the core of the product line back to a more affordable $1,000-$5,000 price point with new positioning aimed at the spirit and mindset of the HENRYs.

Even at $2,000, a TAG Heuer watch is luxurious. The new branding tagline, “Don’t Crack Under Pressure”, and its alignment with youth-skewing sports brands like Red Bull as well as celebrity icons, like Super-Bowl champ Tom Brady, super-model Cara Delevingne, and tennis star Maria Sharapova, are intended to resonate with HENRYs.

Aspirers (chart above) are on their way up and want to be perceived as players. For them, luxury is about showing social status and prestige.

Cocooners are all about the home; decorating it, furnishing it, surrounding themselves in a cocoon that makes them feel warm, secure, comfortable and happy.

Home brands are largely missing out on selling to Butterflies by focusing on selling the “thing,” rather than focusing on the experience.

While X-Fluents enjoy luxury to the fullest, they may, or may not choose the most exclusive and expensive brands.

Temperate Pragmatists are concerned about the environment and the negative effects of the typical American throw-away, disposable consumer lifestyle.

For more information on these Henry personalities, check out the first part of this series in the May/June2017 issue of Furniture World Magazine (see the digital editions section at www.furninfo.com).

Getting to the “Why” of the Brand

In a recent talk at the Hackers on the Runway conference in Paris organized by TheFamily, marketer Seth Godin asked, “Is Digital the End of Luxury Brands?” His question should have been, “Is the Digital Generation, i.e. young HENRYs, the End of Luxury Brands?”

The key challenge for home brands and the young HENRYs is not about how they connect, but how to create new and compelling reasons why their brands are meaningful and important to this digitally-empowered generation.

Getting to the “why” of the brand is where the future of marketing to HENRYs starts. New branding and marketing strategies are what’s needed, not just creative programming or digital-marketing tricks. It is all about tailoring the brand message to the unique psychology of younger consumers on the road to affluence.

Today, luxury brands telling old luxury stories of exclusivity, status, indulgence and over-the-top extravagance repel more than they attract. New narratives are required that maintain the elevation of the brand above the masses, yet connect with the unique consumer psychology of the next-generation luxury customer, democratic, not elitist.

This doesn’t necessarily mean that traditional luxury brands must forsake the qualities and values that made them great, but pruning and shaping strategies and messaging to keep the luxury brand vital and relevant may be required.

Today too many luxury brands focus on new marketing and messaging tactics when focusing on HENRYs, while ignoring the strategic shifts that need to be made. And that requires putting the customer front and center. Forget about the history of what the luxury brand used to stand for and give HENRYs the luxury they really want, need and desire.

About Pam Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer segment. She is president of Unity Marketing, a boutique marketing consulting firm she founded in 1992 where she leads with research to provide brands with actionable insights into the minds of their most profitable customers.

She is also a founding partner in Retail Rescue, a firm that provides retailers with advice, mentoring and support in Marketing, Management, Merchandising, Operations, Service and Selling.

A prolific writer, she is the author of eight books including Shops that POP! 7 Steps to Extraordinary Retail Success, written about and for independent retailers. She is a contributor to The Robin Report and Forbes.com. Pam is frequently called on to share new insights with audiences and business leaders all over the world. Contact her at pam@unitymarketingonline.com.