Planning to shop & choosing stores to visit.

Understanding what motivates shoppers to open their wallets, write a check or flash some plastic is every furniture retailer’s dream. As the entire industry seeks to continuously breathe new life into marketing, advertising and promotion, understanding the key drivers of consumers’ furniture purchasing decisions is critical to building market share and enhancing revenue.

In this first of two articles, the findings of a recent national study are presented in which furniture buyers were asked how they made decisions about furniture purchases. There are four critical stages in the purchase process. Delivering against consumer needs at these four stages will greatly enhance advertising effectiveness.

Stage One

PLANNING AND RESEARCH

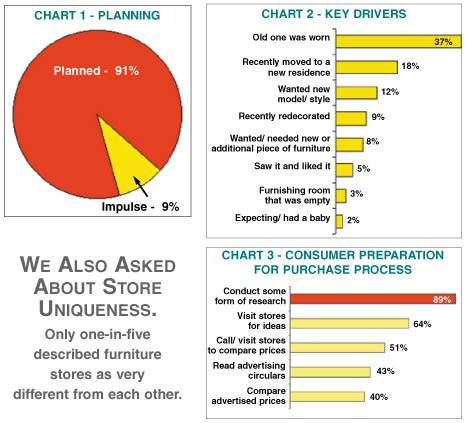

At the initial stage of the buying process, there are several key findings to consider. First, it comes as no surprise that the furniture purchase process begins when a consumer identifies a need or desire for an item. Our study revealed that most furniture purchases are planned (91 percent) – not surprising when considering the few instances of a furniture emergency (chart 1). The largest percentage of consumers purchased furniture ‘to replace worn items’ (37 percent), followed by ‘recently moved to a new residence’ (18 percent), and ‘wanted a new model or style’ (12 percent) (chart 2).

Second, when consumers made the decision to buy furniture, nine out of ten actively conducted some form of research or information gathering to decide where to shop and what to buy. Of the furniture shoppers surveyed, 64 percent visited the stores for ideas, 51 percent called or visited stores to compare prices, 43 percent read store advertising circulars, and 40 percent compared advertised prices. (See chart 3)

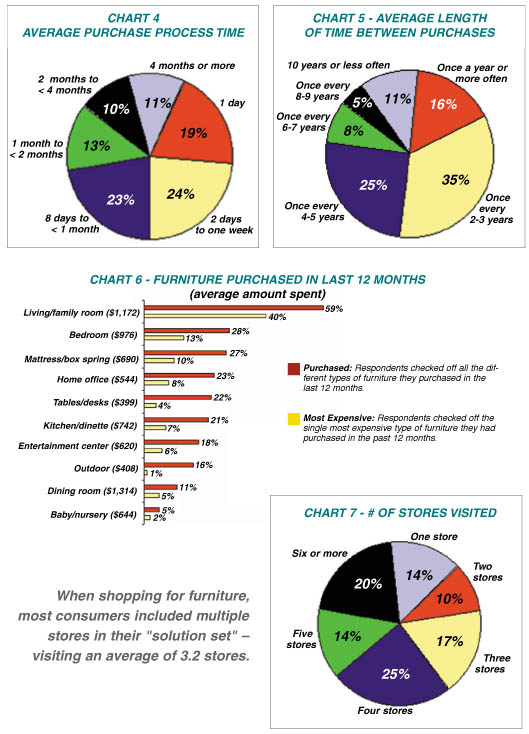

Interestingly we found the amount of time a consumer spent on a furniture purchase is relatively short for some shoppers: 43 percent made a purchase in a week or less. One in five shoppers took only one day to purchase their furniture from the time they started looking (chart 4).

Consumers appear to be buying furniture more often. In our 1999 study we found that, on average, people bought furniture once every four years. In our 2001 survey, the average time between purchases has decreased to once every 3 years. In fact, 51 percent of consumers surveyed in 2001 made a furniture purchase totaling more than $200 at least once every two to three years, with 16 percent purchasing furniture once a year or more (chart 5).

Respondents were also asked which types of furniture they bought in the past year, how much they paid for each type, and which furniture purchase was most expensive. No discrimination was made between high-end and low-end furniture stores or discount stores, etc.; therefore the average amount spent is across all store types. Living/family room furniture was purchased by 59 percent of consumers, who spent on average $1,172. At a distant second, 28 percent of consumers purchased bedroom furniture, spending an average of $976. For 40 percent of shoppers’ living/family room furniture was the most expensive purchase they had made that year (chart 6).

In summary, the findings show consumers’ furniture purchases are largely planned, and most are preceded by some form of research. This would strongly argue for retailers to frequently advertise to consumers to remain top-of-mind. Moreover, marketing and advertising material should be designed to help consumers with their research by providing information that will help drive them to your store.

Stage 2: Lets Go Shopping

The second stage in the furniture purchase process is deciding where to shop. When shopping for furniture, most consumers included multiple stores in their "solution set" – visiting an average of 3.2 stores. Of those surveyed, 76 percent visited three or more stores, and 10 percent visited two stores. Only 14 percent visited just one store before making their purchase.

Consumers also visited the store where they made their purchase an average of two times prior to making their purchase: 22 percent made four or more visits, 32 percent three visits, 29 percent two visits, and 17 percent made one visit to the store to make their final purchase (chart 7).

Familiarity with a store is paramount to a furniture shopper. When asked how they had learned about the store where they made their purchase, 55 percent of respondents had previously bought items from the store, 46 percent had known about the store for some time, and 29 percent had seen advertising (chart 8).

We also asked about store uniqueness. While the majority of consumers described furniture stores as at least somewhat different from each other, only one in five described them as very different from each other (chart 9).

Given the fact that consumers are most likely to purchase from stores they have shopped at previously or are already familiar with, relationships with existing customers are critical. In order to bolster those relationships retailers should consider creating loyalty programs to keep customers informed of new items and sales and encourage repeat business.

There is a significant opportunity to create awareness among consumers who have never visited your store by clearly communicating overall style and quality of products offered and available price ranges in your advertising.

Finally, because consumers generally view furniture stores as similar to each other, it is essential to differentiate your store from your competitors. Retailers should first evaluate the competition and see how they can set themselves apart on services, in-store experience, price, location and variety of products or services offered, then leverage these selling points in your advertising.

Read next month’s issue of Furniture World for information on item selection and in-store experience – stages three and four of the furniture purchasing process and the related implications for retailers.

Research Background: The ADVO study was conducted by NFO WorldGroup, one of the world's leading providers of research-based marketing information. The study was conducted using a panel, a nationally representative group of households that have agreed to participate in research studies and are replenished routinely to maintain the integrity of the panel. In July 2001, a Consumer Panel Screener survey was used to identify U.S. households that had purchased furniture in the past six months. Follow-up questionnaires were mailed in September 2001 to approximately 750 past six-month furniture purchasers who had spent at least $100 on a new item of furniture. The questionnaire was completed by the primary or co-decision maker for the furniture purchases in the household. Seventy-three percent of the primary or co-decision makers were female. While typical response rates for panel studies range from 65 percent to 70 percent, the ADVO study saw a 79 percent return rate for this study.

About the Author: Joella Roy is Senior Marketing Research Manager at ADVO, Inc. ADVO is the largest full-service targeted direct mail marketing services company in the United States. The company’s shared mail advertising programs are distributed to over 100 million U.S. households. Questions can be sent to Ms. Roy care of FURNITURE WORLD Magazine at editor@furninfo.com.