US Holiday Sales to Cross $1 Trillion for First Time

Furniture World News Desk on

11/8/2019

Despite healthy consumer spending overall in 2019, the upcoming holiday season will be affected by economic uncertainty and a shorter timeframe. (This year has six fewer days between Thanksgiving and Christmas than in 2018.)

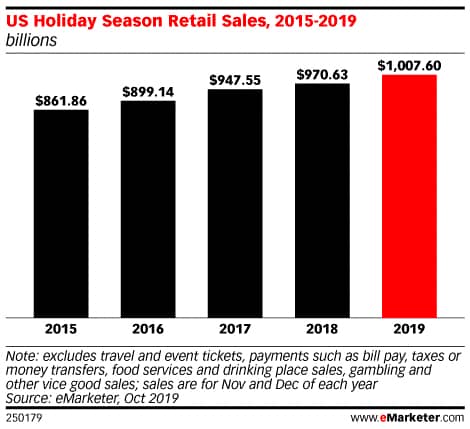

We forecast that total US holiday retail sales will climb 3.8% to $1.008 trillion this year-the first-ever trillion-dollar holiday season. Last year saw even less growth, at 2.4%.

Cyber Monday is once again expected to be the biggest online shopping day in US history, with a total that could approach—or even surpass—$10 billion. Black Friday, Thanksgiving and “Cyber Tuesday” should also rank among the leading days for the season.

“Holiday spending growth will be driven by a consumer economy that remains robust, due to low unemployment, rising wages, a strong stock market and healthy consumer confidence,” eMarketer principal analyst Andrew Lipsman said. “At the same time, rising tariffs, trade war tensions, stock market volatility and dampening consumer sentiment all weigh on the season’s growth potential. A shortened calendar between Thanksgiving and Christmas also presents a challenge.”

Brick-and-mortar remains dominant. In-store sales for the 2019 holiday season will increase by 2.5% to $872.25 billion. Brick-and-mortar still represents the majority (86.6%) of holiday sales, but its share has steadily declined.

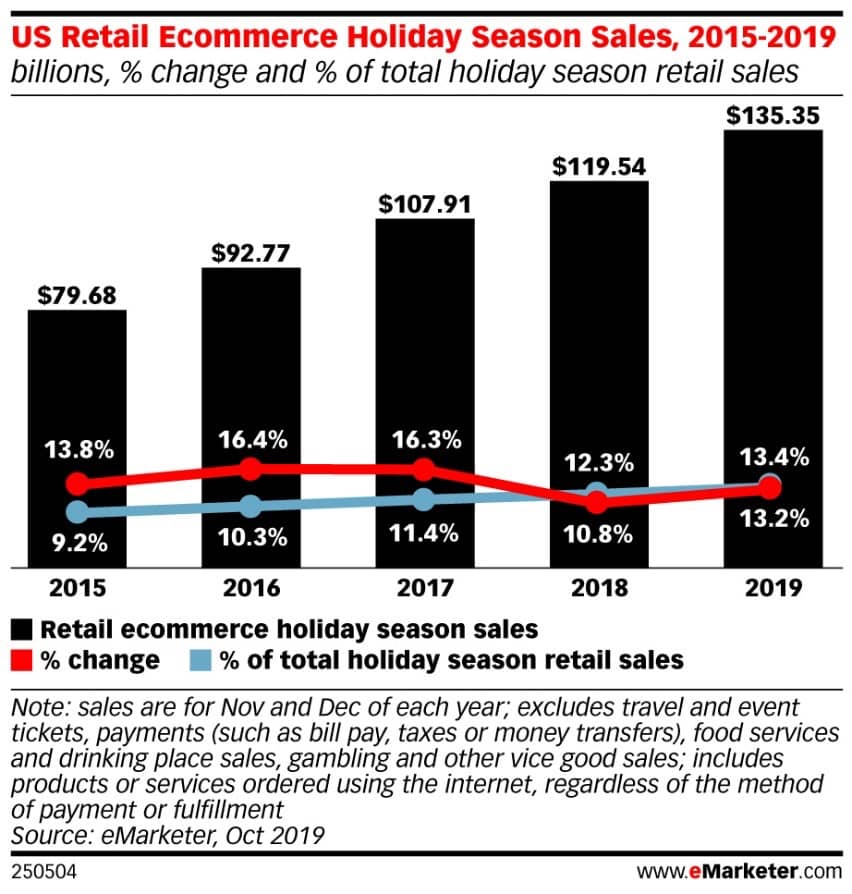

Ecommerce sales this holiday season will increase 13.2% to $135.35 billion. That means ecommerce will represent 13.4% of all holiday retail sales this year, a figure that has been growing steadily.

“The largest online and big-box retailers appear well positioned for the 2019 holiday season,” Lipsman said. “With fast shipping at a premium during the compressed holiday season, retailers like Amazon have an advantage for online deliveries, while those with advanced click-and-collect operations like Walmart, Target and Best Buy will also get a leg up on the competition.”

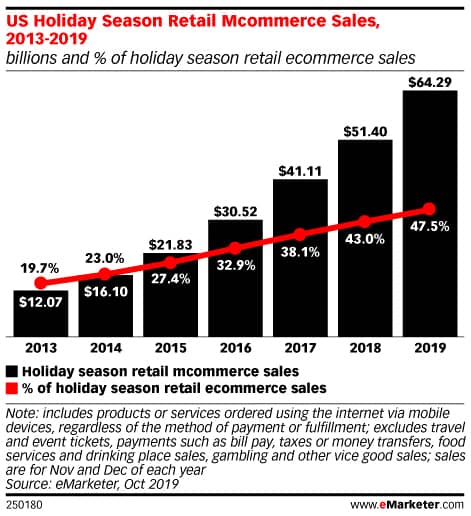

While mcommerce (sales via smartphones and tablets) will drive just 6.4% of total holiday retail sales, it will be the fastest-growing shopping channel.

We estimate mcommerce will grow 25.1%, and it will represent 47.5% of holiday ecommerce sales this year.

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

About eMarketer: Founded in 1996, eMarketer is the first place to look for research about marketing in a digital world. eMarketer enables thousands of companies worldwide to understand marketing trends, consumer behavior and get the data needed to succeed in the competitive and fast-changing digital economy. eMarketer’s flagship product, eMarketer PRO, is home to all of eMarketer’s research, including forecasts, analyst reports, aggregated data from 3,000+ sources, interviews with industry leaders, articles, charts and comparative market data. eMarketer’s free daily newsletters span the US, EMEA and APAC and are read by more than 200,000 readers globally. In 2016 eMarketer, Inc. was acquired by European media giant Axel Springer S.E.