What sales volume do you need for the coming year? Far too often store owners do not take this question seriously enough, or avoid it all together. To just beat last year’s numbers is not a good enough answer! Approaching this question properly from an analytical standpoint helps set the stage for the development of a meaningful business strategy. Only once a realistic targeted annual sales volume is defined can the monthly benchmarks to achieve that target be set.

The formula to figure your required sales volume is an extension of the break-even sale equation. Break-even sales is the volume you need to achieve to begin to make a profit. A discussion of the Break Even calculation can be found on the furninfo.com website. Use the search field to search for “Break Even” then click on the Furniture World article titled, “Retail Break Even Analysis”.

Profit is not an option so you must be decently above breakeven sales. Once you reach your break-even point your fixed costs are covered. The only costs incurred then are variable costs. Your variable costs are costs that are incurred only when a sale is made. They include expenses such as selling commissions and cost of goods sold. If you add the profit dollars that are required for your business to your fixed costs in the break-even sales equation you will arrive at your required sales volume.

Here are the steps:

1. Determine 2013 Total Sales

2. Determine 2013 Total Expenses

3. Determine 2013 Variable Costs.

For example:

- Landed Costs of Goods Sold

- Any sales discounts or rebates

- Selling commissions

- Credit card fees

- Sales financing fees

- Net delivery income and expenses

- Other variable costs

4. Figure Fixed Costs (costs that don’t change with sales volume): Fixed Costs = Total costs – Variable Costs.

5.

Determine Contribution Margin: This is the percentage of every dollar in sales after break-even sales that go towards profit. Contribution Margin = (Sales – Variable Costs) / Sales.

6.

Determine Break-Even Sales Volume: Break-even Sales = Fixed Costs / Contribution Margin.

7.

Decide on realistic or desired Net Income for 2014: This is the amount of dollars that add to cash flow after all expenses are covered. 7-10% of sales is what I consider decent profitability.

8.

Figure the Sales you need for 2014: Required Sales Volume = (Fixed Costs + Desired Net Income) / Contribution Margin.

9.

Conduct alternate scenarios based on changing fixed and variable cost amounts.

10.

Decide the final Sales Volume that is required.

11.

Set sales strategy and metrics to achieve Volume: Required Sales Volume = Required Selling Opportunities x Required Closing Rate x Required Average Sale.

An Example:

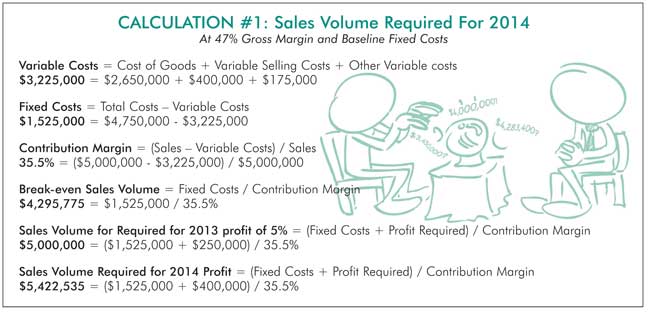

Let’s look at an example that closely resembles an actual operation with 2013 Annual Sales of $5,000,000. This retailer had a gross margin of 47%, so 53% COGS %. Their total operating expenses were 42% of sales or $2,100,000. Their net income was, therefore, $250,000 or 5% profitability before tax. 8% of sales were variable selling costs, 3.5% of sales were credit card and financing costs. Net delivery income & expense was zero due to properly charging fees for delivery costs. All other costs were considered fixed. This business wanted to produce $400,000 net income before taxes at the same cost structure mix. See the numbers in “Calculation #1: Sales Volume Required For 2014” that shows how, to earn an extra $150,000 in profit dollars, the company will need to sell $422,535 more in 2014 at the current variable and fixed cost mix.

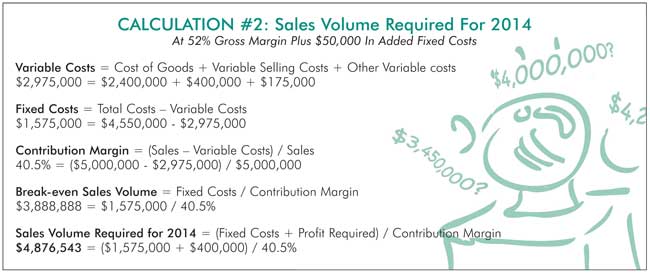

Now, let’s suppose they take a variety of actions to improve their gross margin to 52%. They will also add a new sign costing $50,000, a fixed amount. This calculation is shown at the bottom of page 16.

So, in the scenario where the business increases margin to 52% and adds $50,000 in fixed costs, the result is actually a lowering of the break-even sales volume which drops to $3,888,888 from $4,295,775. This is due to a higher contribution margin. Under these conditions, the store will get to break-even faster and make 40.5% instead of 35.5% out of every sales dollar after reaching that level of sales. In this scenario the business actually can produce more profit at a lower sales level. $4,876,543 would produce $400,000 in profit.

Once you have performed a similar calculation for your operation to determine your required sales volume, you can figure out the selling equation necessary. The components of the selling equation are Average Sale, Close Rate, and Selling Opportunities.

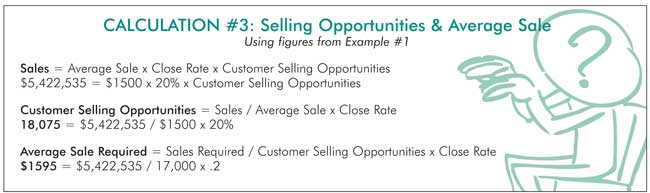

Using the non-modified cost structure assumptions in Calculation #1 let’s determine how this retailer might go about producing $5,422,535 in sales (Calculation #3 above). We will hold close rate constant at 20% and use an average sale of $1,500.

Calculation #3 shows that this retailer would need their sales people to interact with 18,073 customers during the year or around 1,500 customers per month. Alternately, if it were possible only to get 17,000 customer interactions per year or 1,417 per month they would need a higher average sale at a 20% close rate to reach the required sales level of $5,422,535.

To achieve the required sales volume at a 20% close and 17,000 customer visits their salespeople overall will need to produce a $1,595 average sale for the year.

By using the break-even sales equation your business can see in advance what volume will be required to produce your desired profit. You will be able to create a meaningful strategy and plan better for the upcoming year. In doing so, you will be able to set benchmarks along the way so that your sales team can be totally aware of the numbers that they need to hit.