Within a mere seven years, the U.S. has suffered the top two most expensive extreme weather storms in her 236 year history, Hurricanes Katrina & Sandy. The category five Hurricane Katrina in 2005 packed winds as high as 174 mph with 30 foot storm surges and heavy rainfall. It devastated the Southern Gulf Coast at a $45 billion price tag to the insurance industry. Our most recent hurricane, Sandy, arrived in October 2012 attacking the Northeast. At its peak only a category two, Sandy became the largest Atlantic

hurricane on record with a diameter of over 1100 miles. The final insurance industry price tag is to be determined, but recent estimates are $20 billion.

Furniture Store Insurance Policies: Check the Fine Print

These catastrophes affected many hundreds of furniture dealers. The most common perils experienced were true tests to the ‘FINE PRINT” of their property insurance policies.

Damage to stores and warehouses along with loss of income or business interruption were caused by a number of “perils” during these catastrophes. Commonly reported were fire and explosion, wind and hail, power outage, flood, storm surge, sewer backup and overflow.

The Special Perils Property Insurance Policy form, which all dealers should have, reads that the “perils” (what you are insured for) are “all risks” (anything that happens) but subject to specific exclusions. If specific damage is not excluded by an exclusion condition or limitation it is covered.

Each of the major perils that occur will be addressed in turn to help give you a better understanding regarding what is covered or not, and how to cover if possible. Please note this is only a short sample and you should refer to your policy for all of the exclusions.

Retail Store Perils

Fire & Explosion: Fire and Explosion are covered perils no matter the cause. Of course arson by you is excluded!

Wind & Hail: Damage resulting from wind and hail are covered perils under most policies. Claims for wind damage, primarily to roofs were by far the most common type of covered claim made during recent big storms. Also covered is rain water damage caused following the failure of a roof due to a wind/hail storm.

Wind/hail claims are often accompanied by business interruption claims, an important topic that will be explained in more detail in a future article.

Be aware that in coastal or wind/hail prone areas, the carrier may insist on a percentage of value deductible. This deductible range can be as low as 1% to as high as 10%. You should understand that a 5% wind/hail deductible does not mean 5% of the loss, but rather 5% of the total value insured. So if your store is insured for $2 million, the deductible is $100,000.

Power Outage: Power Outage is an excluded peril of a property policy no matter what the cause. This was the most common not-covered loss encountered during Hurricane Sandy.

Sandy caused local generating plants to suspend operations. Electrical lines were blown down, customers and employees were without power, deliveries could not be made and, nobody was out shopping. Repair times were measured in weeks or longer. Loss of income occurred, but since most of the retailers who experienced power outages had no direct physical store damage, the standard business interruption coverage did not apply.

For retailers who want to ensure against power outages, insurance carriers make available, by rider at an additional premium, coverage for direct damage and off premise utility service power outage. Carriers generally limit their exposure on this rider, offering twenty-five to fifty thousand dollars in coverage, and occasionally up to one hundred thousand.

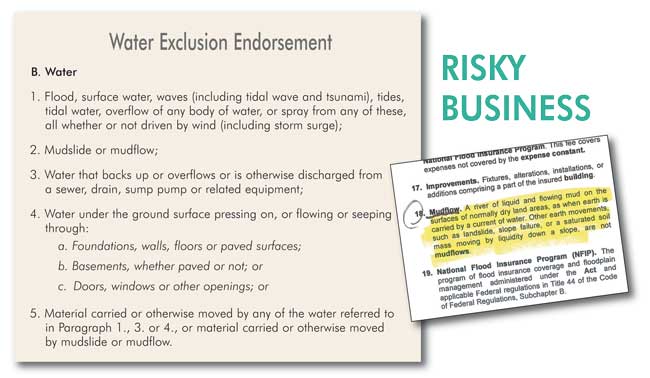

Water Damage: You may think that you are covered for all types of water damage under your policy, but this is not the case. In 2008 in the aftermath of Hurricane Katrina, the insurance industry rewrote its Water Exclusion Endorsement, shown above.

This exclusion applies if the damages specified in paragraphs 1-5 are caused by an act of nature or any other reason. A basic rule of thumb is that water such as precipitation that comes down from above results in a covered loss, but that water coming up into your store or warehouse from under ground or at ground level isn’t covered.

After the failure of the levies in New Orleans during Katrina, exclusion #5 was added to the Water Exclusion Endorsement to exclude coverage due to a situation where a dam, levee, seawall or other boundary or containment system fails in whole or in part, for any reason, to contain the water. If you are in an area where there is a danger of this type of loss, it’s not going to be covered.

But, if any of the not covered risks outlined in the Water Exclusion Endorsement results in fire, explosion or sprinkler leakage, insurance companies will pay for the loss or damage caused by that fire, explosion or sprinkler leakage.

Flood Coverage Through NFIP: Flood is and always has been an excluded peril under property insurance, however, coverage can be purchased by furniture dealers for maximum limits to $500,000 Building, and $500,000 Contents, through the National Flood Insurance Program (NFIP), a program administered by FEMA. More information on this program (that does not offer business interruption coverage) can be found at http://www.floodsmart.gov. This site has lots of information including assessing risk, commercial coverage, questions to ask your agent and, flood maps for some areas.

Premiums increase with risk calculated based on a number of factors, primary among these location.

My experience is that most retailers who are not in a flood prone area, or aren’t required to purchase flood insurance due to conditions of a mortgage agreement, don’t buy it. And, if they do purchase a policy, it often has the lowest limit and highest deductible. If you aren’t insured for this risk or have a minimal policy, now is a good time to get as much information as you can about your specific risks, including the recent history of changing weather patterns.

Sewer Back Coverage: Sewer Backup or Overflow as in paragraph B. #3. is an excluded peril as well under the Water Exclusion Endorsement, but coverage can be purchased through standard carriers as a rider to the policy at an additional cost. Limits available are at the carrier’s discretion.

Risk of Under Insuring Inventory

In the case of a loss due to extreme weather, It makes good sense to insure buildings and inventory at replacement value to avoid a co-insurance penalty that can be substantial. For buildings, our agency uses the Marshall & Swift/Booeckh (MSB) system to estimate replacement value.

There are some retailers out there that have, for example, a ten thousand square foot building insured for two hundred thousand dollars when replacement value is five times that amount. An even bigger potential problem, and one that’s more widespread, is under-insuring inventory value. Unlike estimating building replacement value with the MSB, the value of inventory and building contents is based on the retailer’s valuation. Stating a low value does have the advantage of lowering premiums. The cost of this is an increased risk of having to self-insure inventory should a fire or severe weather strike.

Next issue

In the next issue this series will address the topic of business interruption insurance.