The Matrix is the starting

point for retailers to adjust square

footage allocated by product

category over

time, for optimal results.

When a retail store owner hires a store designer to re-imagine an outdated store interior, it’s most often because he or she wants displays updated, traffic flow and sales improved.

As a retail designer, I’ve helped hundreds of store owners rethink their showrooms, so I don’t dispute that the showroom layout is vitally important.

But before you can configure a space, maximizing sales requires looking at the product categories you currently sell and figuring out what percentage of sales come from each category. Why? Because, as a rule of thumb, the amount of merchandise you display should correspond to the percentage of business you do in each category.

In other words, if you have a 100,000-square-foot store, and 55 percent of your business is in upholstery, you’ll dedicate 55,000 square feet of retail space to upholstery. There are exceptions of course.

The Merchandising Matrix

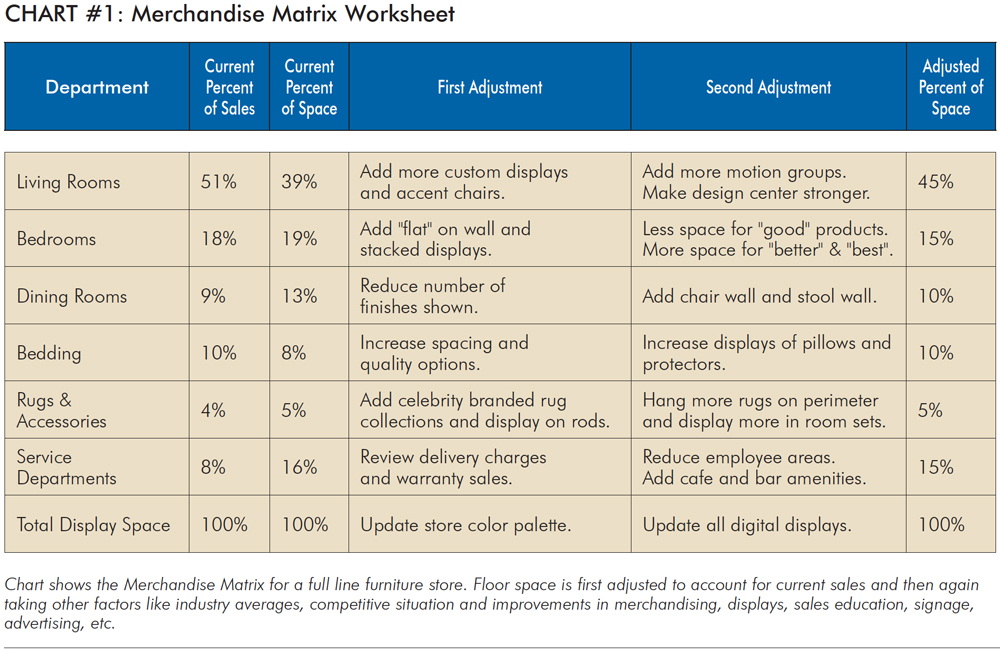

A good way is to start with a simple tool called a Merchandising Matrix that enables store owners to figure out how much square footage they might devote to each product category.

This matrix (See Chart) lists product categories, bedroom, living room, dining room, etc. It also lists current square-footage, and percentage of business done for each category.

The value of optimal floor space allocation to product categories cannot be over-estimated. To do it right, assemble a team that includes managers, buyers, visual merchandisers and designers to develop your Merchandise Matrix.

First determine the room set size you use for a category, then multiply it by the number of rooms you display. So for example, if you currently use a 10‘ x 15’ room set size for stationary upholstery, and you have 28 room sets, that department takes up 4,600 square feet of floor space, excluding main access aisles.

Once you’ve calculated square footage for each department, the next step is to analyze your sales figures. By determining the percentage of sales that come from stationary upholstery, for instance, you’ll be able to compare the amount of space you now allot to that department to the percentage that should be allotted. You may discover that you have too much or not enough stationary upholstery in your product mix and that you’ll need to make adjustments. But, you might also discover that in some cases you were fairly accurate in estimating the amount of merchandise for a given category.

Most furniture retailers tend to stick with the floor space allocations they already have when designing a new store or upgrading an older one. If they are showing 25 bedrooms, they stick with that number. It’s not the best way to optimize sales or profitability.

One of my clients, an owner of a well regarded furniture store, adopted the Merchandising Matrix, only to be surprised by the results. He realized that some of his guesstimates for how much product he should purchase were way off the mark. In one instance, he thought he needed five or six sets in a department, only to discover that he really needed three, and he already had two in the warehouse. In the first month after redesigning his store, sales increased by 24 percent, a fair amount of which can be attributed to the new merchandising process.

The Merchandising Matrix chart allows retailers to give pride of place to products that are doing the lion’s share of the business. I am not exaggerating when I say that this method will radically improve your bottom line, enabling you to achieve higher dollars-per-square-foot.

Purchasing Pitfalls

Too many merchants, like cowboys in the Old West, shoot from the hip when making purchases for their store. Being strategic and disciplined in displaying the right amount of product per department goes hand in hand with purchasing.

Most retailers start with the best of intentions, shopping list in hand, when market rolls around. Unfortunately, there are so many ways to lose sight of the original plan and start buying emotionally. It’s all too easy to get caught up in the excitement of market and to make spur-of-the-moment purchases. Or, decide to take advantage of a hot market special, or feel you owe a sales rep a generous order out of friendship.

But when you follow the Merchandising Matrix approach, you are more likely to make well-thought-out purchases, since you know in advance exactly how many items will fit in each category of your showroom layout.

How you use the most valuable asset you have as a retailer—your square footage—can be crucial to your success. You air-condition it, heat it, light it, maintain it, and spend money on real estate, taxes and everything else. Why not adopt a strategy that helps you make the best and most profitable use of that space?

If the average retailer

is doing 30 percent

of its business in a

category such as

stationary upholstery,

and your store achieves 20 percent, you have to look at why your store is under-performing. |

Adjusting Matrix Results

Applying the results of the Merchandise Matrix is more art than science. It’s important to interpret the numbers.

Check industry averages: Check research done by the trade press regarding the average space retailers say they allocate to product categories and sub categories to ascertain where your space allocations might be obviously out of balance or under-performing.

For example, let’s say the average retailer does 20 percent of its sales volume in mattresses, but your store only achieves five percent. Using the Matrix, you might consider reducing the floor space devoted to mattresses to five percent and increasing the footprints of your upholstery and bedroom furniture departments.

However, if published industry averages say the average retailer is doing 30 percent of its business in a category such as stationary upholstery, and your store achieves only 20 percent, you first have to take a close look at why your store is under-performing. Is it because your other departments are over-performing, or that something else is hurting return on investment for a particular product area? It’s important to look at the relationships among all departments and apply a test of reasonableness.

Evaluate your competitors: Let’s say the industry average for upholstery sales is 50 percent of total sales volume. If your competitors do a great job of selling upholstery, then selling 50 percent of your volume in upholstery might be just fine for your store. If, on the other hand, your competition does a poor job of selling upholstery, there might be an opportunity to increase the upholstery business through a variety of means.

Get results fast: If a department is doing well, it can usually do better quickly. What we’ve learned is that it’s better to improve an already high producing department. If 50 percent of a retailer’s sales volume is produced out of its upholstery department, increasing sales by one percent there, yields a lot more dollar volume than getting a one percent increase out of a department such as youth furniture that might produce only five percent of total volume.

Other options: Other than increasing a department’s floor space, retailers can take many other actions to improve product category performance. They can adjust staffing, focus on product selection, replace poorly performing sales associates, invest in sales education, purchase new signage, work on visual merchandising, upgrade lighting, offer better credit options, encourage add-on sales, and initiate free design services to increase the size of average sale.

When you follow the Merchandising Matrix approach, you are

more likely to make

well-thought-out

purchases,

since you know in advance exactly how many items will fit in each category of your showroom layout. |

Creating a retail selling machine is not about adding carousels and fun things for kids to do in- store. These types of attractions may increase traffic, but won’t actually sell product. What a retailer sells how they sell it and how they emphasize areas within their retail environments, are what makes a difference in terms of sales volume.

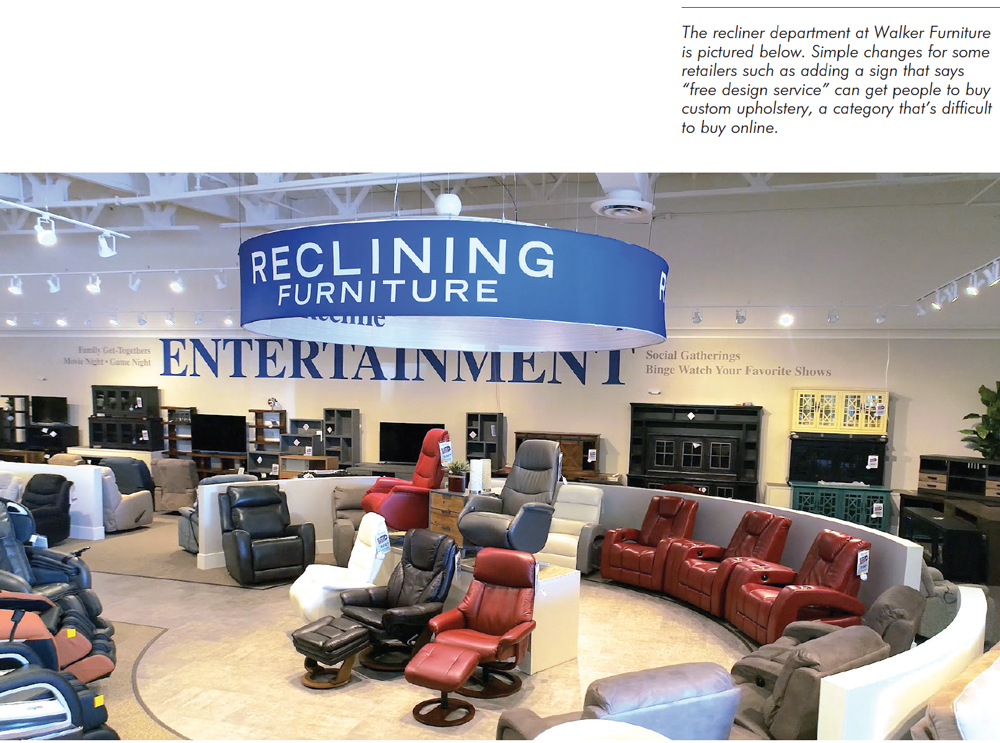

Simple changes: Simple changes for some retailers such as adding a sign that says “free design service” can get people to buy custom upholstery, a category that’s difficult to buy online. Customized upholstery usually yields higher margins, and is less subject to internet competition, a definite advantage.

Expand popular and growing product categories: Many retailers can, for example, benefit by working to increase their motion upholstery sales. It’s a popular and growing category under-represented in terms of space allocation on a lot of retail floors.

Small stores: If you are a small store that carries a broad selection, consider eliminating categories that contribute a small percentage of sales. You might decide not to carry children’s products if they only contribute between one and five percent of overall business. Allocating space to higher volume categories can help to maximize sales volume.

Outlet Stores

Often stores have spaces at the back of their stores that were formerly warehouses or used for a receiving area that can be re-purposed. Ideally, they can be converted into an outlet store with a separate entrance, devoted to products at lower price points that don’t compete with the existing business.

Retailers may also find space for an outlet center at a distribution center or warehouse space that services a number of stores. As malls are becoming less populated with major brands, furniture retailers are finding opportunities to lease cheap spaces, which can make good outlet stores.

We are seeing more good, better, best, selling. Good is an outlet, better are regular priced goods, and best are designer collections. Retailers are seeing an opportunity to create a ladder for customers at different points in their life.

One of our top-100 clients has multiple stores in close proximity. Its main store at 150,000 square feet sits next to its higher end store at about 40,000 square feet. Also, an Ashley’s store which is about 30,000 square feet, a clearance center that’s about 15,000 square feet. Five blocks away is its outlet store that is about 60,000 square feet. And they all do well because each appeals to a different audience.

Circling back to the topic of floor space allocation in outlet stores, we’ve found that showing a lot of inexpensive accessories in them is a waste of time. They just don’t produce enough sales to make it worthwhile. Outlet stores that replace accessories with upholstery, find that sales have gone up dramatically, as much as 25 percent. It reduces clutter and they avoid having items that sit around for years and look dated.

Upholstery can be piled up three high against a wall, like Ashley is doing now, and it can be priced sharply in an outlet store because at least 50 percent of the business is in upholstery anyway. Smaller footprint stores need to be especially careful with editing their selections, and devote more floor space to the strongest selling categories to increase sales volume.

Rugs, pillows, lamps, and decorative objects of various kinds are often best placed into a boutique inside a designer store. When they start looking dated, perhaps once a year, they should be pushed out by holding a garage sale or moved to an outlet store for a period of time to free up space because it’s bad business to have old accessories in a designer store.

In a regular, better-priced store, accessories tend to be seasonally driven. Green and red at Christmastime for example. So, their sales become seasonally driven. Space permitting, many retailers move them out into racks at the back of the store and bring them back in again the following year. They are window dressing, really, no more than five percent of total business and usually three percent.

Rugs are a different deal. They work well in outlet stores. And the higher-end store we designed for a furniture retailer includes 2000 square feet of designer rugs. They are using designer celebrity branded collections that brings credibility to the rug design and selection based on the personality of the designer.

Conclusion

Every space allocation has to have a reason. Why did a visual merchandiser allocate a 15 foot by 12 foot space to some room sets but only 12 foot by 12 foot to others? Why are some areas under-performing when compared to industry averages? And, can this be improved by adjusting the floor space allocation or is something else going on? These decisions should be overseen at a corporate-team level based on strategic factors, not only by a visual merchandiser. That way a retailer may make errors, but at least they know why they made those decisions.

When you look at the percentage of space allocation, along with the return on investment by category and then track the number of sales per month in each category, it becomes possible to get your head around and adjust areas where business is performing well or under-performing.