China’s Top eCommerce Players Increase Their Market Share in Disruptive Year for Retail

Furniture World News Desk on

6/17/2020

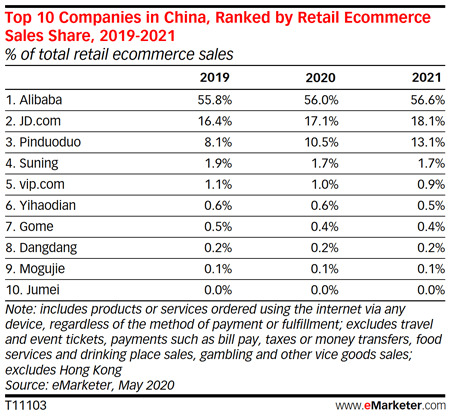

Although 2020 will prove to be a disruptive year for retail sales in China, the rich will get richer when it comes to the major ecommerce platforms. Alibaba has long been the dominant player by virtue of its ubiquitous Taobao and Tmall options, and it will continue to hold the top position for the foreseeable future. JD.com will also maintain its respectable second-place position, and Pinduoduo (PDD) will continue its meteoric ascent. The only change in positioning to emerge from the pandemic is that market share will increase for each of the major players, at the expense of the smaller players. This had not been the case in recent years.

Alibaba held 55.8% of the retail ecommerce market in 2019. We now expect that share to grow by 0.2% (we previously predicted a slight decline), even though Alibaba’s growth will increase at a slower rate than we previously forecast (16.5% instead of 18.7%). JD.com will experience the same phenomenon, growing slightly slower than we previously forecast yet still gaining share. PDD, the exciting newer player on the block, will continue its explosive trajectory as well, leading to a collective decline in share for the remainder of the top 10.

All told, Alibaba, JD.com and PDD will command 83.6% of the market in 2020, compared with 80.3% last year. Before COVID-19, Alibaba had been losing share for many years—mostly to JD and PDD, but also to smaller challengers. However, it will reverse that trend in 2020 thanks to its resilience during the lockdown and its ability to supply China’s buyers with the full suite of essential supplies they were seeking.

By contrast, smaller challengers like Jumei, Dangdang, Vipshop (vip.com) and Mogujie (all of whom overly rely on selling discretionary products like apparel, cosmetics, electronics, etc.) will suffer from very poor H1 sales this year.

TOTAL RETAIL

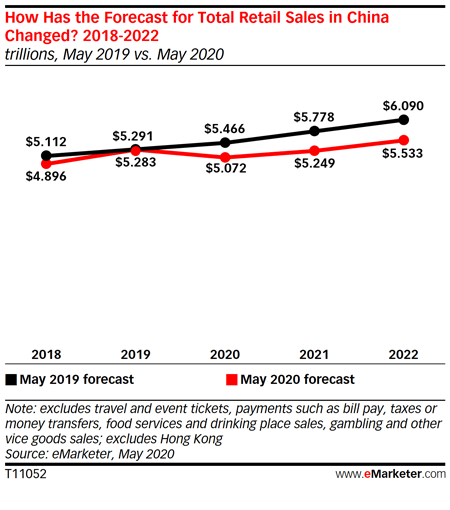

Amid the unprecedented disruption of the COVID-19 pandemic, China’s retail market is expected to decline for the first time on record (dating to at least 1985). Under our baseline scenario, we estimate that retail sales in China will shrink by 4.0% this year, despite retail ecommerce growing by 16.0%. Notwithstanding the decline in total retail, China will become the largest retail market in the world in 2020, because the US market will shrink by an even larger margin.

ECOMMERCE

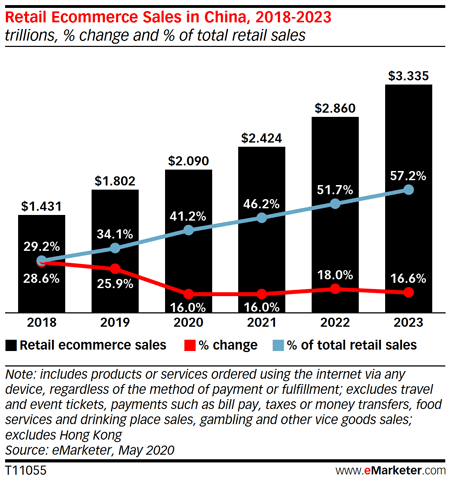

China’s overall retail ecommerce sales are expected to increase at a healthy clip in 2020, although at a slower rate than previously forecast. We forecast a 16.0% growth rate in retail ecommerce sales this year, which is 7.7 percentage points less than our pre-pandemic estimate but still indicative of roughly $288 billion (RMB1.990 trillion) in additional spending compared with 2019.

“Like in many other countries in 2020, China’s retail ecommerce performance is a tale of two countervailing coronavirus-related outcomes,” said eMarketer analyst Ethan Cramer-Flood. “On the one hand, ecommerce jumped because China’s residents were forced to remain indoors for long stretches and could not go to brick-and-mortar stores. On the other hand, ecommerce has been constrained by recessionary pressures, negative consumer confidence, and a short-term move away from luxury items and discretionary purchasing (which form the core of many ecommerce platforms).”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

About eMarketer: Founded in 1996, eMarketer is the first place to look for research about marketing in a digital world. eMarketer enables thousands of companies worldwide to understand marketing trends, consumer behavior and get the data needed to succeed in the competitive and fast-changing digital economy. eMarketer’s flagship product, eMarketer PRO, is home to all of eMarketer’s research, including forecasts, analyst reports, aggregated data from 3,000+ sources, interviews with industry leaders, articles, charts and comparative market data. eMarketer’s free daily newsletters span the US, EMEA and APAC and are read by more than 200,000 readers globally. In 2016 eMarketer, Inc. was acquired by European media giant Axel Springer S.E.