Unlike purchase behavior which can change on a dime, consumers' underlying psychology is their set point.

Understanding the motive to buy is ultimately the most important perspective for any home furnishings retailer. This is the psycho-graphics or psychology of your customers and target customers. Unlike purchase behavior, which can change on a dime, consumers’ underlying psychology is their set point; it characterizes their basic motivations regardless of how other factors change.

A spend-thrift consumer tends to always be a spend thrift unless they make a concerted effort to change their behavior. A penny- pincher tends to remain a penny-pincher, regardless of whether they accumulate a lot of money or not. Warren Buffett, who is renowned for his thrifty personal lifestyle, is a case in point.

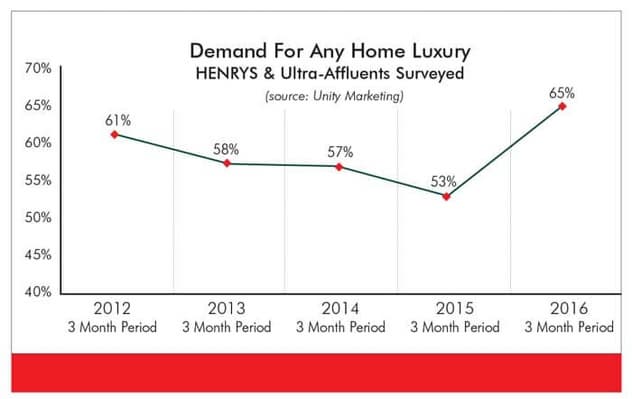

Motive explains why people buy, so it’s vital to make sure through marketing efforts and shopping experiences that your offerings meet customers’ specific needs. Let’s look more closely at the consumer psychology of the consumer demographic segment that will be the most important for the future of furniture retail businesses, the HENRYs. HENRYs are a large, highly niched target market. If you are not intimately familiar with them, check out "Home Hungry HENRYs: Home marketers best new home prospects" in the January/February 2017 issue of Furniture World (www.furninfo.com/furniture-world-articles/3658).

Customized Marketing

To make a meaningful connection with HENRYs, consider customizing your marketing messages and the mediums to deliver your messages effectively so that they resonate, make an impression and inspire them to buy. The challenge with HENRYs is that as far as messaging is concerned, one size does not fit all!

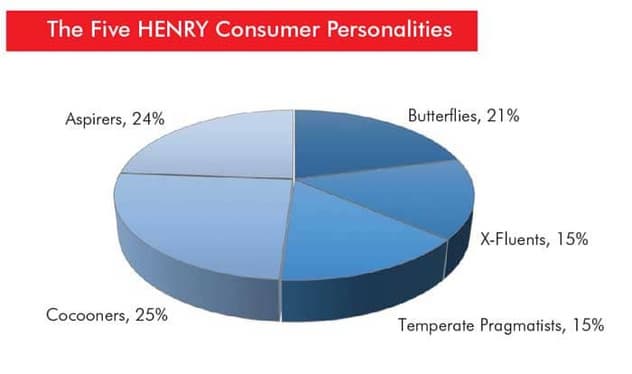

Unity Marketing's research has identified five different personalities that make up the HENRY consumer segment.

For home marketers, three of the five HENRY personalities represent a strong potential market. These are the X-Fluents, Aspirers and most especially Cocooners. The other two, Butterflies and Temperate Pragmatists are less important because they are not all that concerned with the home, or less inclined to indulge in higher-priced, premium products for their homes.

However, even the two least home-motivated consumer segments can be enticed, with the right positioning and the right marketing messages, to consider high-end home purchases as valuable to their quality of life.

Let’s look more closely at each of the five HENRYs and how best to sell home goods and services to each.

X-Fluents live luxury ‘large’

The X-Fluents are “extreme affluents,” making up about 15% of the total HENRY demographic. The other 85% simply don't have the money to allow them to live luxury as large as the X-Fluents. For the X-Fluents, luxury touches every aspect of their lives, including the cars they drive, the way they decorate their homes, the clothes they wear, accessories they carry, and the places they stay. They are confident and live luxuriously for their own personal gratification, not to display their status to others. When marketers think about the quintessential “luxury consumer,” they usually have X-Fluents in mind.

But while X-Fluents enjoy luxury to the fullest, they may, or may not choose the most exclusive and expensive brands. They are value-shoppers, not in the sense that they are looking for cheap or discount, but they are extremely focused on getting the most value for the money they invest.

An X-Fluent shopper may love your $5,000 chair or your $10,000 leather sofa, and she or he certainly has the money to pay for it, but they might not be willing to buy it if the brand is too common, or another less expensive brand offers comparable quality and style. Today, the X-Fluents opt for value and a quieter, authentic and less conspicuous luxury lifestyle.

Aspirers want to be seen as 'players'

The Aspirers, who make up slightly less than 25% of the HENRYs, have yet to reach the level of luxury to which they aspire. Aspirers are on their way up and want to be perceived as players. For them, luxury is about showing social status and prestige. They are less secure and confident than the X-Fluents, and believe that the glitz and the glamor that comes from the status-symbol brands they own identifies them as successful. However, their incomes may not yet match their aspirations.

An Aspirer may want to own a showy $5,000 Viking stove or $10,000 Lee Jofa custom-fabricated sofa, but he or she may not be able to afford it. An Aspirer is more likely to purchase the lowest- priced model of that brand’s luxury range as a stopgap, or simply wait until their income catches up with his or her luxury aspirations.

This is the personality that brands talk about the 'aspirational' customer are targeting. Fewer than one-fourth of HENRYs fit this personality and there are more male Aspirers than female ones. So aspirationally-targeted messages are clearly missing the mark for the other personality types.

Cocooners express luxury in their homes

Cocooners account for another quarter of the HENRYs and are prime targets for home marketers selling premium-priced goods.

Cocooners express luxury in and through their homes. Cocooners are all about the home; decorating it, furnishing it, surrounding themselves in a cocoon that makes them feel warm, secure, comfortable and happy. And, they are core customers for well-designed, prestige brand bath and kitchen appliances and fixtures, high-end furniture and expensive home furnishings and decorative items.

Cocooners tend to focus their luxury indulgences on things for the home, not on items for themselves. That means Cocooners may look more like fashion victims than fashionistas when out shopping. Their dress won’t signal affluence. As a result, a Cocooner might be overlooked as a good potential customer for high-end appliances, furniture, decorative home furnishings and other items for the home.

Cocooners also might be scared off if your brand or shopping experience is too X-Fluent or Aspirer focused. That is, it doesn’t speak to his or her more traditional, hearth-and-home lifestyle.

Today many luxury brands, among them Vera Wang, Ralph Lauren, and Fendi, are extending their ranges into the Cocooners’ home territory, so they are increasingly going to have to speak her language. They ignore this customer segment at their peril, because Cocooners are prime candidates for high-end and premium home brands. For Cocooners, the attraction isn’t sophistication like for the X-Fluents or status like the Aspirers, but genuine quality and comfort in style.

Butterflies value experiences over things

Then there are the Butterflies who value experiences over material things. While HENRY Butterflies may enjoy a nice lifestyle and own many nice things, Butterflies prefer to spend their money on experiences, like travel and fine dining, rather than on material goods.

For Butterflies, luxury isn’t what they own, but rather the things that they experience -- and the joy they share with others from these experiences. When it comes to material things, quality premium or even mass brands, appeal to their sensibility as compared with heritage luxury brands, such as Louis Vuitton, Gucci or Chanel.

Butterflies can dress themselves and furnish their homes well with premium brands bought for less, while saving what’s left to splurge on the high-end travel, dining and other experiences they crave.

Home brands are largely missing out on selling to this highly experiential customer by focusing on selling the “thing,” rather than focusing on the experience they have in shopping, buying, living with, and using that “thing.”

The new RH (formerly Restoration Hardware) understands Butterfly consumers. They've found a ready audience of people not particularly set for acquiring more things for their homes, but eager to participate in living the RH lifestyle, as well as enjoying the RH shopping experience.

Temperate Pragmatists are your worst nightmare

Temperate Pragmatists view luxury with suspicion. For them luxury is just a marketers’ label, not something that has any real meaning. They may enjoy high income and personal wealth, but would rather save it or spend it on things that are meaningful to them.

This personality is utilitarian, practical and oblivious to traditional marketing and branding approaches. Temperate Pragmatists are concerned about the environment and the negative effects of the typical American throw-away, disposable consumer lifestyle. This personality recycles, re-purposes, reuses, and makes do. Do-it-yourself very much appeals to this personality, as does the emerging ‘Tiny House’ movement popularized on HGTV.

They will steer away from overt marketing messages based on prestige, status and entitlement. They favor brands that are solid, well-crafted, long lasting and inconspicuous. A Temperate Pragmatist might own a Viking professional-quality stove or a Miele front load washer, not for the status, but for their engineering and durability.

But they may decide that IKEA is just fine for their kitchen cabinets, and Pottery Barn for their living room sofa. This is also the target customer for the emerging renting and sharing economy.

Many young HENRYs show a decided Temperate-Pragmatic approach to shopping and buying. Living a Temperate Pragmatist lifestyle is in keeping with the younger generation’s concern over the environment, global warming and the negative impact of excessive materialism. If your brand offers a lifetime’s worth of use and can be positioned as a good lifelong purchase, you might get his or her business with that practical sell strategy. But they will not buy more than they need, and they have come to learn that they can get by with much less indeed.

Make It Personal, Relevant, Customized

In marketing, perception is reality. Marketers create that reality in the minds and the hearts of consumers. A one-size-fits-all strategy for marketing to HENRYs, the high-earners with disposable incomes but not yet rich, and maybe never destined to be rich, won't work in today’s increasingly diverse and sophisticated consumer market with so many good products available everywhere and at every price point.

An aspirationally-targeted home brand may well turn off an X- Fluent as being too showy or trying too hard. The Cocooner might be ignored because they don’t look like, dress like or act like one’s idea of an affluent consumer, yet they come to the store with plenty of money to spend on their homes.

The Butterfly will be drawn to brands that promise an enhanced experience in the home, but those home brands focused primarily on look, not feel or comfort, may miss the mark. And the Temperate Pragmatist isn’t tempted by traditional marketing pitches, yet if they consider the investment a practical, useful and good long-term investment, they may well purchase on the spot.

To market to the HENRYs, the gatekeepers to the emerging home market as well as the new target for traditional mass-marketers, brands need to understand the distinctly different psychology of those customers who have discretion and can afford to buy.

That understanding will lead marketers to strategies to attract and inspire the HENRYs in their own language to invest in your brands – for their own special, unique reasons.

About Pamela Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer. She is president of Unity Marketing, a marketing consulting firm she founded in 1992. Pam uses qualitative and quantitative market research to learn about luxury marketers’ brand preferences, shopping habits, and attitudes about their luxury lifestyles, then turns these insights into actionable strategies for marketers. She, has published a new mini-book to serve as a guide to the most important affluent demographic for luxury brands’ future. Entitled, What Do HENRYs Want?, (visit http://bit.ly/1RfgwUX) It is a concise overview of the HENRYs, why this new demographic group is important to brands, and how to connect with this high-spending customer, poorly understood by marketers serving both the mass market and also the luxury markets. For more information visit Unity Marketing at www.unitymarketingonline.com or email Pam188@ptd.net.

Furniture World is the oldest, continuously published trade publication in the United States. It is published for the benefit of furniture retail executives. Print circulation of 20,000 is directed primarily to furniture retailers in the US and Canada. In 1970, the magazine established and endowed the Bernice Bienenstock Furniture Library (www.furniturelibrary.com) in High Point, NC, now a public foundation containing more than 5,000 books on furniture and design dating from 1620. For more information contact editor@furninfo.com.