Each of us has a big investment in the home furnishings industry. As a result, we would all like to have confidence that this is an industry with a promising future. I would like to discuss that future.

First, we are in a recovery albeit a slow one. It is now being led by the housing sector which did not perform well in 2010 or 2011. Housing has picked up dramatically since the second half of last year. This is promising, since no post World War II economic recovery has gained momentum without housing playing a leading role.

This long, slow economic recovery has taken a big toll and has greatly changed our industry. We have fewer competitors at retail. Our numbers show that there are 56% fewer smaller stores today than in 2002. Of course, the big have gotten bigger. The top ten furniture stores in Furniture/Today’s top 100, were 19.8% of all of the furniture retail business in 2002 and grew to 28.7% in 2011.

At the same time, large competitors have entered the furniture industry. Non-furniture store retailing including warehouse clubs like Costco and Sam’s Club, mass merchants such as Target and Wal-Mart, internet retailers including Wayfair and Hayneedle, office superstores like Staples and Office Depot, and any number of other non-traditional furniture store retailers have continued to make gains. Non-traditional retailers were responsible for 36.5% of the furniture and mattresses sold in 2002. This figure grew to 42.2% in 2011. These retailers find the home furnishings industry increasingly attractive for some of the demographic and lifestyle reasons we will discuss below.

demographic changes

Over the last forty years the residential furniture industry has catered to one dominant consumer base, the 76 million Baby Boomers born from 1946 to 1964. This is a huge group, dramatically larger than the 54 million in the prior generation, and they’ve had a large and consistent economic impact. Our industry has grown with them from their first apartments, to their first homes, to where they live today.

Millennials: The hot new group for our industry are the Millennials, 73 million strong, now 16-34 years of age. This group, the children of the Baby Boomers, are introducing new workers seeking employment into the US economy at a rate of 100,000 per month. Statistics show that 39% of young people 18-34 years old who are sometimes laughingly termed “Back-Homers” now live at home with their parents or other family members. Twenty-four percent never left home, while 15% left but were forced to return because of the recession and a lack of job prospects. As the economy improves, not only will the natural progression of the Millennials exiting high school, college or the military positively affect the retail furniture industry, we will see “Back-Homers” leaving home, entering the workforce and setting up households.

GenX: The next big group that will affect our industry is Generation X, aged 35-48. There are 48 million of this group, smaller than either the generation before or after them. Most have had all of the children they are going to have but those children are still at home. Spending typically peaks with American households between 35-44 so Generation X now is at its peak vs. other age groups. Because they are fewer in number, this group is having a taxing effect on a retail base that was built to service the 76 million Baby Boomers. The 48 million Generation Xers cannot support that massive retail mass. This is a reason we’ve seen continued shrinkage in the number of brick and mortar retailers. Gen X is reasonably well educated and is certainly more computer savvy than Baby Boomers, but they are not as computer savvy as the younger Millennials. Of course, the Millennials will not be as computer savvy as their children either, and the technology cycle keeps on going.

Baby Boomers: The Baby Boomers are now 49-67 and there are 76 million of us. They are buying larger homes, second homes and are at the peak of their earnings. As this group matures past 60 they will save more and spend less. Many will be moving into smaller homes, as their children leave home (eventually).

Ethnic Landscape

One of the reasons to be excited about our industry’s future is the growth of certain ethnic groups. In the next twenty years, the US population will grow from 310 million people in 2010 to 374 million people by 2030.

Asian Population: During this time, the Asian population will grow from 5% to 6% of the total. Asian households are the wealthiest of all ethnic groups in the US.

Hispanic Population: The best growth will be with the Hispanic population, expected to grow from 16% in 2010 to 23% by 2030.

African American Population: The African-American population will stay a flat 12%, according to most studies, but since the population is growing, they will be too.

Anglo Population: The Anglos will be shrinking from 65% of the total population to 56% in this 20-year period, but the absolute number in the white population will continue to grow but much slower than other ethnicities. Of course, there are other differences because the Anglo population will be much older than either the Asian or the Hispanic population, so the impact of these population subsets will continue to have greater influence over the next 20 years.

Lifestyle Changes

There are additional shifts as well. In 1970 17.1% of all households were made up of individuals living alone while in 2010 that percentage was 30.2%. That is a huge change brought about by divorce, people waiting later in life to marry, and lifestyle changes. As you might imagine, large households of five or more have declined from 20.9% in 1970 to 8.4% in 2010.

Migration

Our population is migrating. People move for jobs, recreational opportunities and for comfort. The West and Midwest have been the beneficiaries in recent years with the worst states in terms of incoming migration being Maine, Rhode Island, Connecticut and New York.

Migration is also being driven by dramatic shifts in the need for labor. We are in a crude oil and natural gas production boom that is going to create a tremendous number of energy-related jobs in the Midwest and West. Both the plastics and chemical industries are expanding rapidly in the U.S., employing a lot more people. The fastest growing states according to Kiplinger are Florida, Texas, Utah, Colorado, Nevada, Arizona and both of the Carolinas. The Millennials need 100,000 new jobs every month, plus we have nine million people out of work that need to be employed just to catch up with where we were before the recession. Of course, one of the most positive factors is housing. Our sources expect housing construction to add 700,000 new jobs in 2013.

Housing Growth

In the fourth quarter of 2012, despite negative growth in GDP, residential construction rose 15.3% and it was expected to grow in 2013 by 17.5%. The number of foreclosures peaked, driving a recovery in existing home sales, but now, in some markets, there is a shortage of homes available for sale. The inventory of used homes down is about 20% from where it was this time last year.

Prices: Home prices having fallen 32.5% from 2005 to 2011, bounced back 6.4% in 2012, and we expect them to rise about 5.0% this year. Homeowners seeing this bounce may get an opportunity to finally sell their homes. Home buyers may rush into buying homes before the prices go up further.

Inventory: Most people above 50 never expected to see a mortgage rate below 5%, but today 3.6% for a 30-year mortgage is commonplace. Rates are getting more support because lending is loosening up as well.

There is solid growth in existing home sales, new home sales and starts are booming, especially in multi-family units last year. Single family starts in 2013 should grow faster. We expect existing home sales which were 4.3 million in 2011 to have reached 4.7 million in 2012 and be approximately 5.1 million this year. New single family home sales which were 307,000 in 2011 and 365,000 in 2012 should reach 469,000 in 2013. Meanwhile, starts are expected to go from 612,000 in 2011, to 781,000 last year, to 975,000 this year. That strong, consistent growth will create new jobs and tremendous demand for home furnishings for the remaining furniture retailers.

The United States has an aging housing base with 41.6% of our homes built before 1970. A new home in 1970 was approximately 1,600 sq. ft. These older homes may be a prime target for home furnishings sales but on a smaller scale. To sum up the housing sector, there will be a housing boom; it is just a matter of when… but it is looking good for 2013.

Conclusions

Healthy Housing Market: As stated previously, there will be a housing boom, not a fake one driven by investors and unusually generous mortgage terms as in the first half of the last decade, but by fundamental demand within our population.

New Niches: Instead of having the Baby Boomers dominate our population in all retail markets as they did from the late 1960s into this last decade, we will have many new markets and lots more retail niches. This should present an opportunity for all types of retail to prosper and grow. It will be increasingly difficult to service everyone in this broad marketplace.

Entreprenurial Opportunities: These changes will bring about new, more entrepreneurial ways of retailing. For example, we expect retailing in the future to have significantly less on-site inventory with more direct to the consumer delivery, often with the retailers never seeing the delivered merchandise. We expect more auction-type sales, not unlike the eBay culture we have all learned to accept. More personalization of our product will become commonplace and not just the “mass customization” that we have heard about for the last twenty years. We expect more mixing of high-end signature pieces with more popular-priced merchandise to extend the budget and allow American consumers to make more of a decorating statement, again personalizing the home.

Segment Growth: Finally, we see the internet and brick and mortar growing together because both serve a purpose. A recent study by Dimensional showed that a majority of Americans still prefer to buy furniture through brick and mortar stores while that is not true with consumer electronics, for example.

Focus On The Home: One way that our economy can reduce its energy costs, reduce pollution, increase worker productivity, reduce wasted time and improve family life, is to focus on the home.

America is about to see a major shift in the way we work, study, shop and do almost every other major activity because all these activities are becoming more home based. In some cases this trend is being driven by government regulations. In Los Angeles, employers with more than 100 workers downtown have to have a minimum of 10% of their workers working from the home or from remote sites to help reduce traffic and pollution. In 2010, the Federal government created a project to lessen commuting for all of the reasons listed above. The “2010 Telework Enhancement Act” states that “Telework can make employees more efficient, more accountable and more resilient in emergency conditions”. The study went on to say that 32% of federal workers should be eligible to telecommute rather than to continue to go to central office sites. This alone could be a major shift in how the home is perceived.

The Associated Press on February 6th quoted a study by the Texas A&M Transportation Institute that said that traffic congestion cost America $121 billion in terms of energy costs and 5.5 billion hours wasted sitting in traffic.

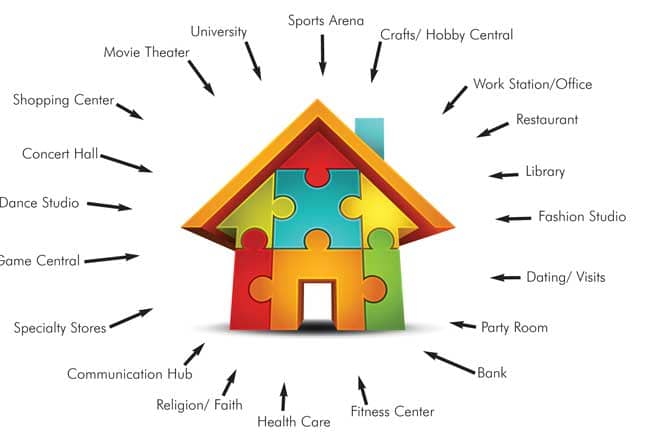

We are coming to a point where the high cost of energy and pollution are creating an opportunity to make US homes more functional. The technology now exists to allow people to work, participate in meetings and exchange ideas from their homes. Not only does this conserve energy, reduce pollution and save money, it helps cut down on commuting, the cost of apparel, child care, auto repairs and many other expenses. Check out the exhibit below that illustrates many home centered activities driven by technological change.

In addition to being the major location for most of the above activities, the house of tomorrow will also include:

In addition to being the major location for most of the above activities, the house of tomorrow will also include:

- Auto-pantry: Application that automatically interfaces a refrigerator or other household items with a smart phone listing. Items needed can be viewed on the phone while shopping in a store or when placing an online order for delivery.

- 3-D printers: Basic models are available in the marketplace for less than $2,000. Future home-based 3-D printers will allow people to work on different projects (architecture, fashion, home design and almost anything else) in 3D. We will be able to buy apparel online and the 3D printer will make it at home.

- Spoken typing: Already available for those who are not comfortable with keyboards; soon computers will also respond to motion, eye movement, voice and eventually thoughts.

- Virtual travel: Those who either are limited in their travel or who do not want the risk of airplane flights and traveling can see the sights, hear the locals and enjoy many of the benefits of travel without the problems.

- Personalized merchandise: This will be increasingly popular as each of us can now order things that either just fit us, our rooms, our cars or meet the demands of our family. Want your initials or photo on everything? No problem.

In closing, you may ask yourself, “What will consumers do with all the money they save by staying home?” I will leave that up to your imagination but we believe that coming demographic and lifestyle changes will create many opportunities for smart furniture retailers.