Henry's, The New Luxury Target for Mass-Market Brands

Furniture World News Desk on

4/23/2015

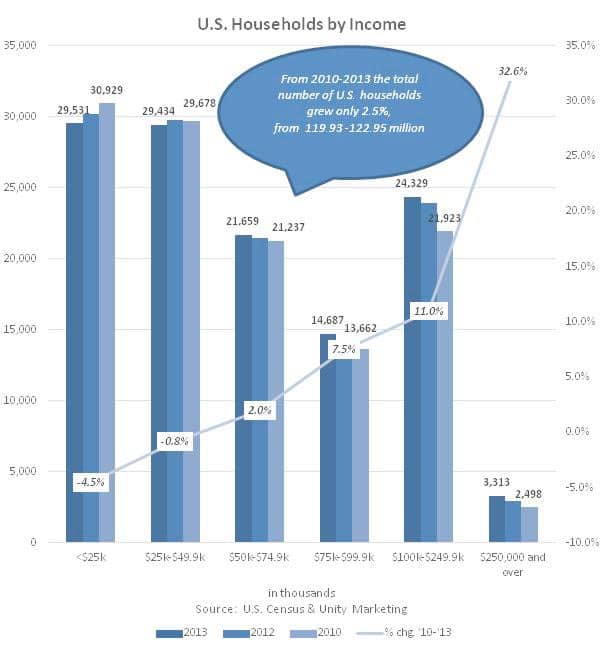

Meet the HENRYs, High-Earners-Not-Rich-Yet consumers with household incomes between $100k and $250k. Pamela Danziger of Unity Marketing noted that the HENRYs are the new face of the mass-market customer, since the traditional middle-class ($50k-$99.9k) lost so much discretionary spending power in the recent recession.

HENRYs are doing better than nearly 80% of U.S. households, but they are a far cry from wealthy; reserve that adjective for the ultra-affluents, who earn more than $250K per year, and for those with high net worth, with amassed wealth of more than $1M.

The HENRYs are the unassuming mass segment of the affluent-consumer market, and critically important for all brands and all marketers to understand. For mass-marketers, HENRYs offer growth possibilities unmatched by the middle-class consumer segment. While the overall number of households grew only 2.5% from 2010-2013, the number of HENRY households rose 11% in the same time.

For marketers aimed at the high-end, the HENRYs are the gatekeepers to the luxury market now and for the future, since ultra-affluent and wealthy customers typically start out as HENRYs on their road to affluence.

This recently updated trend report for 2015, "Meet the HENRYs," highlights just why these lower-income affluents are so important to marketers at all pricing levels, high-end, low-end and in between. "Coming out of the recession, the true middle class are severely limited in their ability to purchase goods and services in the near future," says Pam Danziger, president of Unity Marketing and author of the report. "This means HENRYs are the 'new mass market' for marketers and brands up and down the pricing scale."

For luxury brands, the HENRYs are ready to respond in force, if not necessarily in high levels of individual spending to brands that connect with their mindset and values. While HENRYs spend about half as much as do ultra-affluents on luxury and high end purchases, their significantly greater numbers (24.3 million households) mean that the total value of the HENRY market is about four times that of the ultra-affluent market (3.3 million households).

"Marketers have historically felt that ultra-affluents were their ideal consumer, but there simply aren't enough ultra-affluents to keep luxury brands afloat in today's market," says Danziger. "Instead, luxury brands need to broaden their reach to include the HENRYs. This creates a unique challenge, as they are now competing with mass-market brands that also need to tap into HENRY spending power."

Danziger also found that targeting HENRYs is a sound strategy for helping luxury brands position themselves in the future. "While it is typical for brands to identify a target customer and stick with this demographic as it ages, today's luxury brands need to look at young HENRY consumers age 25-34. As these younger affluents mature, their incomes will rise, making this population the source of most of tomorrow's ultra-affluents. Luxury brands that want to continue to reach the highest income customers need to reach out to slightly less affluent Millennials today."

More about the Meet the HENRYs: Positioning for the Mindset of the High-Earners-Not-Rich-Yet Customers

In Unity Marketing's most recent trend report, "Meet the HENRYs," a profile of these high-value customers emerges by examining their demographics, purchase behavior, and psychographics. This 120-page report discusses the HENRYs in detail and contains actionable strategies for building customer loyalty now and in the future.

For more information on the HENRY report, call Pam Danziger at 717-336-1600 or email

pam188@ptd.net.

About Pam Danziger & Unity Marketing: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer. She is president of Unity Marketing, a marketing consulting firm she founded in 1992.

Pam received the 2007 Global Luxury Award for top luxury industry achievers presented at the Global Luxury Forum by Harper's Bazaar. Luxury Daily named Pam to its list of "Women to Watch in 2013." She is a member of Jim Blasingame: The Small Business Advocate's Brain Trust and a contributing columnist to The Robin Report, a monthly newsletter for senior executives in the retail, fashion, beauty, consumer products and related industries.

Pam's latest book is Putting the Luxe Back in Luxury: How new consumer values are redefining the way we market luxury (Paramount Market Publishing, 2011). Her other books include Shopping: Why We Love It and How Retailers Can Create the Ultimate Customer Experience, published by Kaplan Publishing in October 2006; Let Them Eat Cake: Marketing Luxury to the Masses-as well as the Classes, (Dearborn Trade Publishing, $27, hardcover) and Why People Buy Things They Don't Need: Understanding and Predicting Consumer Behavior (Chicago: Dearborn Trade Publishing, 2004).